Effortless Payroll Outsourcing with Full Compliance Assurance

From expert payroll management and tax compliance to flexi-benefit processing and dedicated support, experience effortless, accurate, and compliant payroll operations

Trusted by over 5000+ HR Managers

Key Features of Our Payroll Outsourcing Service

Empower your payroll with expert advisory, streamlined processing, and personalized support for a seamless experience

Payroll Advisory

Gain strategic insights into CTC structuring, tax-saving opportunities, and compliance adherence, tailored to your organization

-

CTC Structure Optimization: Create efficient, tax-optimized CTC structures

-

Flexi-Benefit Tax Savings: Integrate flexi-benefits to maximize employee tax savings

-

Compliance Best Practices: Ensure all payroll elements align with regulatory requirements

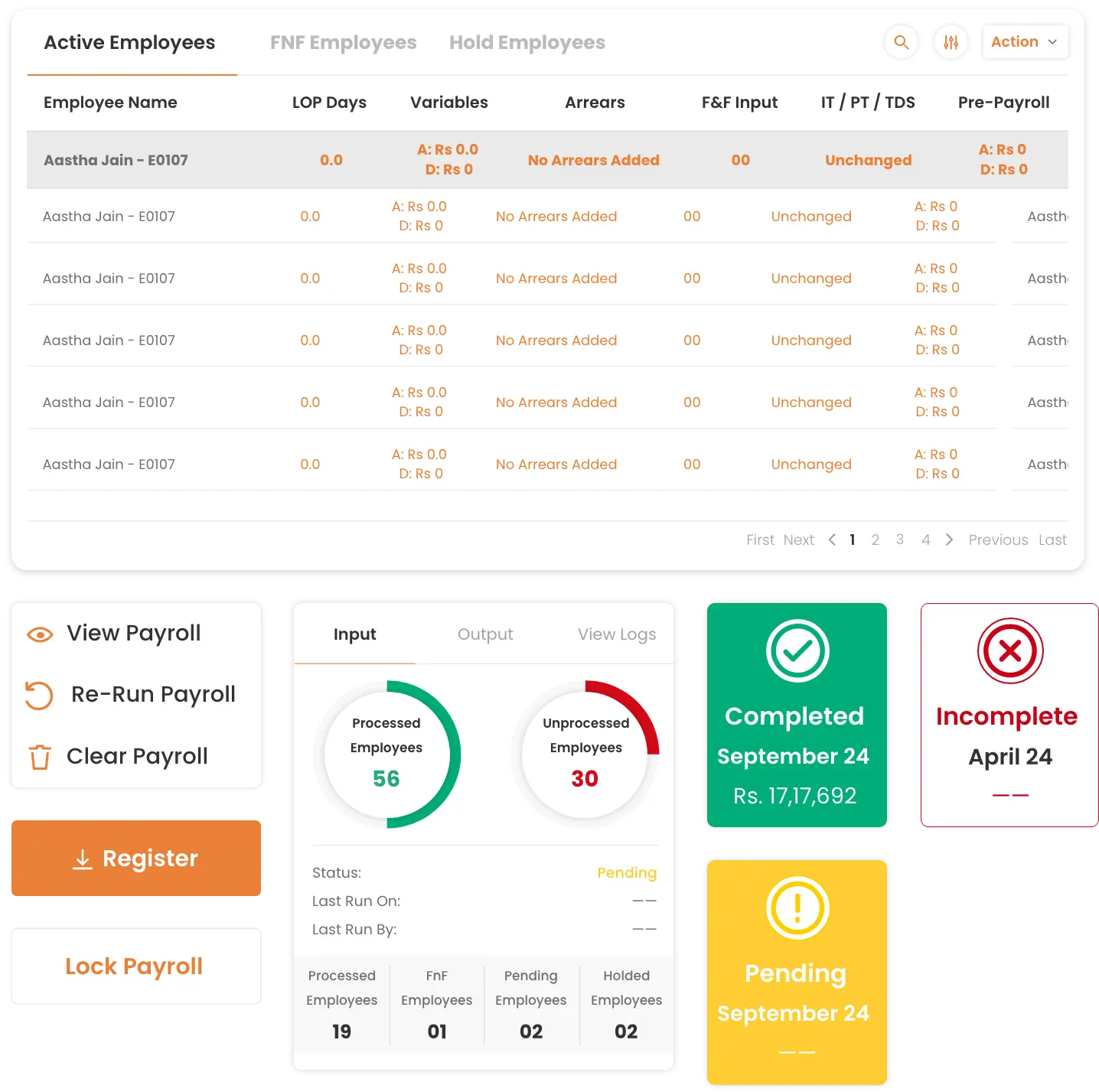

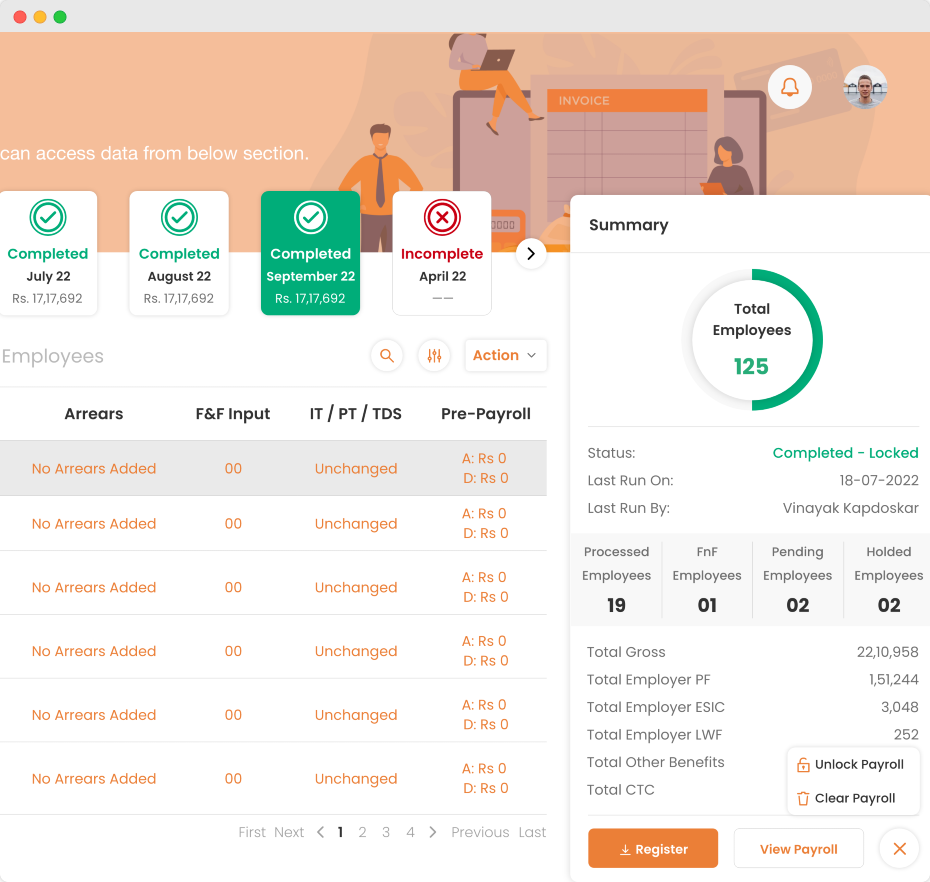

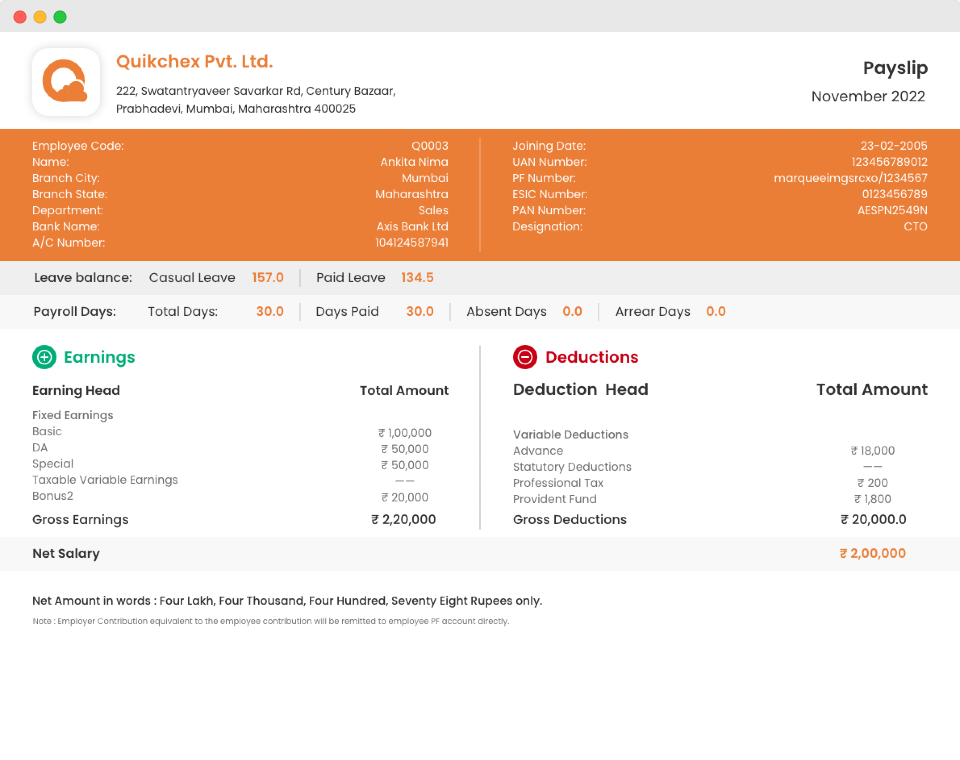

Accurate Payroll Processing

Entrust your payroll to experts, with a meticulous process that ensures accuracy, efficiency, and quality checks

-

Expert-Run Processing: Managed by experienced payroll specialists with a maker-checker system

-

Comprehensive Reporting: Generate detailed salary registers, payslips, and bank transfer reports

-

Automated Payslip Generation: Provide secure, digital payslips accessible to employees anytime

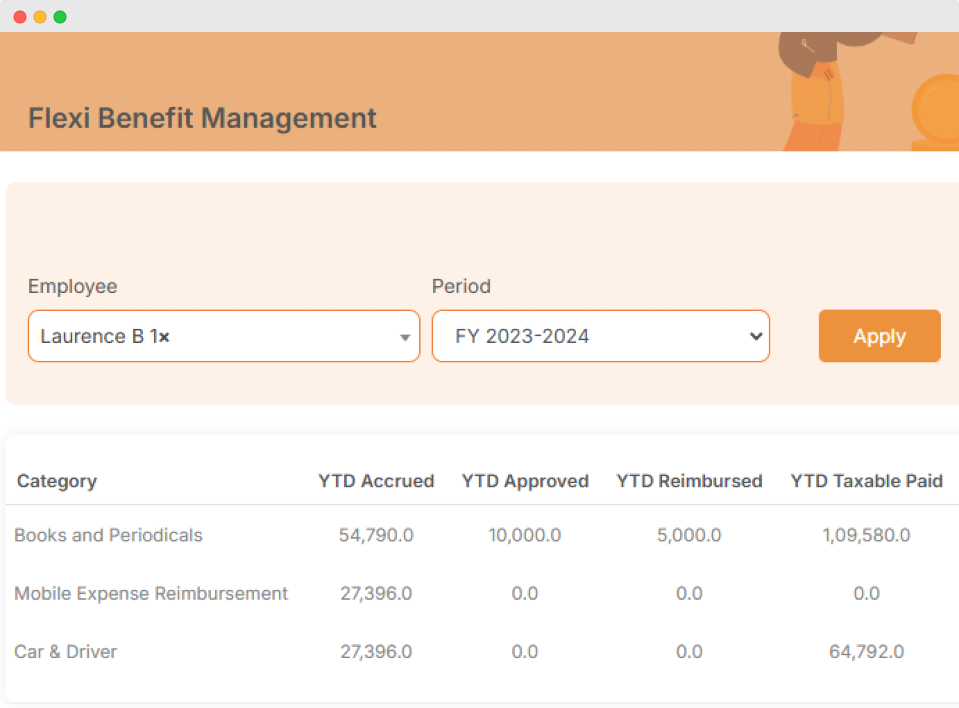

Flexi-Benefit Processing

Simplify tax-efficient flexi-benefits with full support for proof verification and compliance checks

-

Proof Verification: Review and verify flexi-benefit proof submissions for compliance

-

Efficient Processing: Ensure timely and accurate flexi-benefit disbursements

-

Tax Optimization: Support employees in leveraging tax-saving flexi-benefits

Salary TDS Management

Manage TDS with end-to-end support, ensuring accurate deductions and timely compliance

-

Quarterly TDS Return Filing: Handle TDS returns efficiently each quarter

-

Form 16 Generation: Issue Form 16 documents to employees for annual tax filing

-

Regulatory Compliance: Ensure all TDS calculations and submissions meet tax regulations

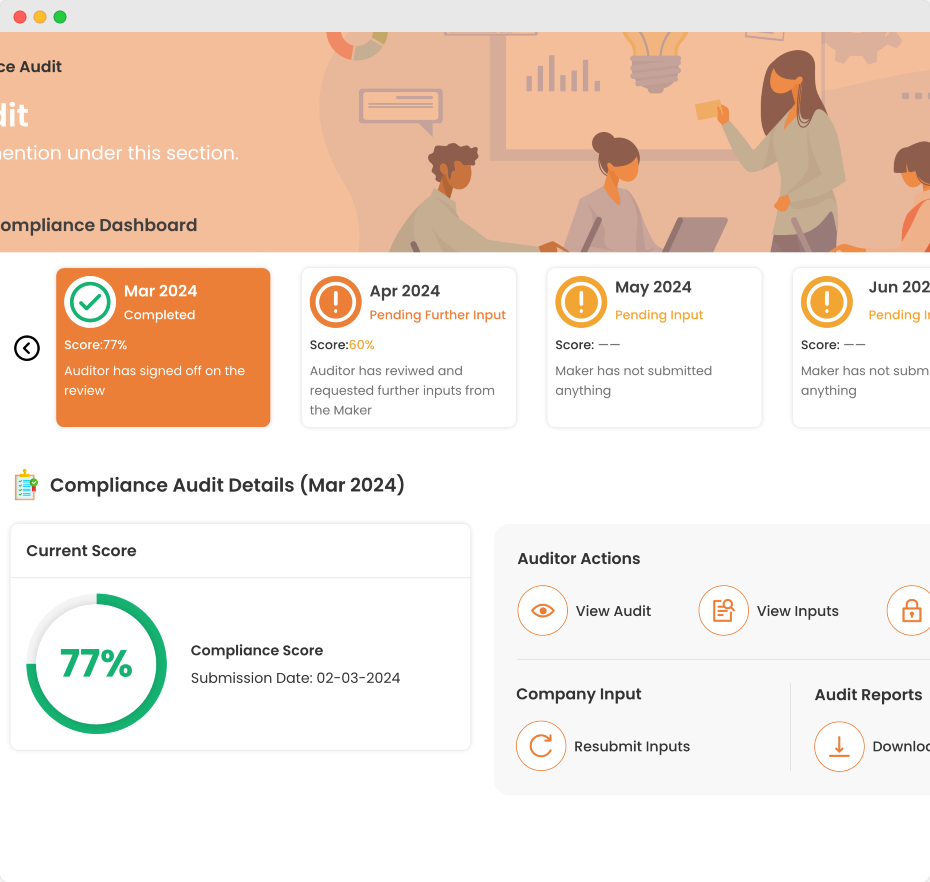

Payroll Compliance Management

Stay fully compliant with proactive management of statutory requirements and payroll taxes

-

PF Compliance: Manage Provident Fund contributions and ensure timely filings

-

ESIC Compliance: Handle Employees’ State Insurance contributions and documentation

-

PT Management: Ensure Professional Tax compliance across applicable regions

-

LWF Management: State-wise LWF Filings

Dedicated Account Manager

Experience personalized support with a dedicated account manager focused on your payroll needs

-

Single Point of Contact: Streamline communication and support with a dedicated expert

-

Tailored Assistance: Receive guidance on complex payroll and compliance queries

-

Proactive Management: Benefit from timely updates and ongoing payroll process optimization

Testimonials

Hear from our users

The Quikchex HRMS platform has been a valuable addition to our HR processes at IIDE. The employee directory works seamlessly, and the leave process setup is intuitive, helping streamline approvals efficiently. The payroll and attendance management modules have also been reliable and easy, making our HR operations smoother.

The user-friendly Quikchex interface has streamlined our processes, saving valuable time. The payroll and attendance system ensures accurate, timely processing. We are particularly impressed with the Mobile App’s attendance capture, eliminating the need for biometric punching. From employee onboarding to performance management, the platform has significantly improved our efficiency. Grateful for the team’s support.

“It’s been over five years since we started using Quikchex software, and it has proven to be incredibly user-friendly and efficient. The platform has consistently made our processes smoother and more streamlined, contributing significantly to our operational ease.”

“We have been using Quikchex Payroll and Employee Management Software since 2017. It is very user-friendly, and the support provided by the team on every module, along with the training, is amazing. The GPS-based attendance module has significantly reduced our payroll processing time from 7 days to 1 day. I have recommended this software to many of my HR colleagues.”

Quikchex provides outstanding support, with a highly knowledgeable and personable team that resolves issues promptly and effectively. Their software handles all payroll and HRMS needs seamlessly, allowing the HR team to focus on innovation. Always just a call away, the Quikchex team handles situations efficiently and positively, making it a brilliant solution backed by an exceptional team.

How does payroll advisory benefit my organization?

Our payroll advisory service offers guidance on tax-optimized CTC structures, flexi-benefit integration, and compliance, helping to create an efficient and tax-saving payroll strategy.

What quality assurance steps are included in payroll processing?

Our payroll processing includes a maker-checker quality assurance system managed by payroll specialists. Detailed reports, including salary registers, payslips, and bank files, ensure accuracy and transparency.

How does the flexi-benefit processing work?

We manage flexi-benefits by verifying proof submissions, ensuring compliance with tax regulations, and processing disbursements accurately to support employees in maximizing their tax savings.

What TDS management services are included?

Our TDS management covers quarterly TDS return filing, Form 16 generation, and compliance checks to ensure all tax-related calculations and submissions are accurate and timely.

How does the dedicated account manager support our payroll needs?

Your dedicated account manager serves as your primary contact, providing tailored assistance, timely updates, and proactive support for all payroll and compliance matters.

Is employee support available for payroll queries?

Yes, our dedicated team provides prompt assistance for employee payroll-related queries, ensuring a smooth experience and quick resolution of any concerns.