How an HRMS can help ensure Payroll compliance effortlessly

What is Statutory Compliance?

Statutory compliance refers to the adherence to laws and regulations set by the government, ensuring that businesses operate within the legal framework established for their industry. In the context of HR and payroll, statutory compliance specifically refers to laws relating to employment, wages, taxation, and employee welfare.

Compliance is crucial for both employees and employers, as it ensures that business operations follow legal standards, protecting both parties from legal issues, penalties, and reputational damage.

Introduction

In today’s fast-paced business world, staying on top of legal requirements is more important than ever. Statutory compliance is the practice of following the laws set by governments to ensure that businesses operate ethically and legally. Whether you run a small startup or a large corporation, statutory compliance affects every aspect of your operations—from how you treat employees to how you handle payroll, taxes, and safety regulations.

This article explores what statutory compliance means in HR and payroll, why it matters, the risks of non-compliance, and how organizations can stay compliant.

What is Statutory Compliance?

Statutory compliance involves businesses adhering to specific laws and regulations established by both the central and state governments. These laws are designed to safeguard employee rights, ensure fair pay practices, provide social security benefits, and enforce workplace safety. In the realm of HR and payroll, statutory compliance specifically refers to adhering to labor laws, tax regulations, and employee welfare policies.

Businesses must abide by these rules to maintain a fair, secure, and legally compliant environment for their employees and avoid legal repercussions.

The Importance of Statutory Compliance

For Employees

Statutory compliance helps protect employees in several ways:

Equal Wages: Ensures employees are paid fairly and according to their job responsibilities, regardless of gender or other factors.

Fair Treatment: guarantees that employees are treated justly and equitably in the workplace, with their rights respected.

Appropriate Working Hours: Limits excessive working hours and mandates proper rest and overtime pay.

Social Security: Ensures access to social benefits like retirement funds, insurance, and health coverage.

Workplace Safety: Mandates companies to maintain safe and secure working conditions.

For Employers

For employers, statutory compliance brings several advantages:

Avoid Penalties: By complying with labor and payroll laws, businesses avoid fines and legal trouble.

Prevent Lawsuits: Following proper legal frameworks minimizes the chances of lawsuits from employees, trade unions, or government authorities.

Harmonious Work Environment: A legally compliant organization fosters a positive and cooperative work culture, boosting morale and productivity.

Brand Reputation: Companies that adhere to statutory compliance enjoy a good reputation, attracting top talent and loyal customers.

Key Areas of Statutory Compliance

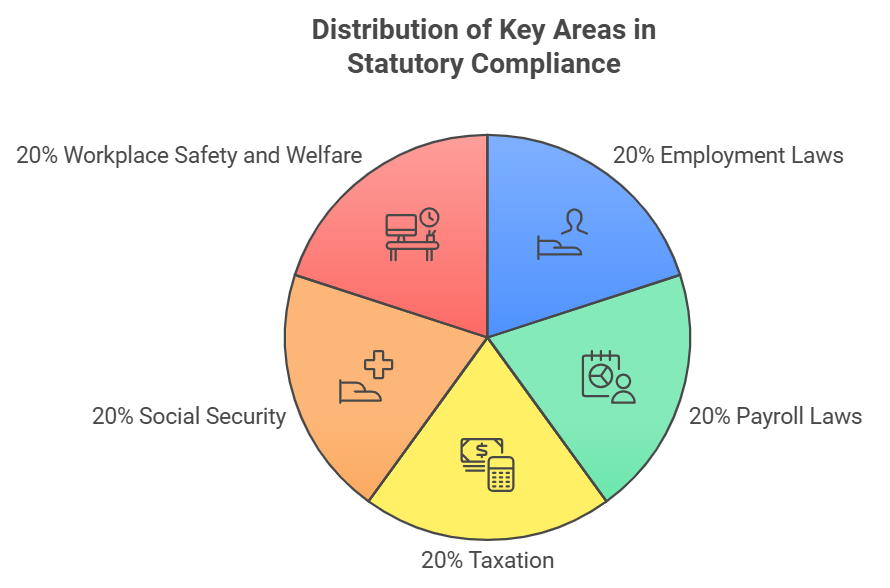

Statutory compliance covers a variety of areas within a business:

Employment Laws: Cover hiring practices, termination procedures, and employee rights.

Payroll Laws: Ensure employees are paid on time, receive the correct amount, and have necessary deductions (like taxes and social security).

Taxation: Businesses must deduct and pay taxes in compliance with the Tax Deducted at Source (TDS) rules.

Social Security: Includes employee benefits like pensions, gratuity, health insurance, and paid leave.

Workplace Safety and Welfare: Ensures a safe work environment with provisions for accidents, illness, and other workplace risks.

Importance of Statutory Compliance in Payroll

Statutory compliance in payroll is crucial for maintaining fairness and legal protection.

Fairness and Protection: Compliance ensures that employees receive at least the minimum wage, proper overtime pay, and correct tax deductions.

Reduced Risk: Adhering to payroll laws minimizes the risk of legal issues and penalties.

Trust and Transparency: When employers follow legal frameworks, it builds trust and transparency with employees, creating a positive work environment.

Risks of Non-Compliance

Non-compliance with statutory laws can lead to serious consequences.

Penalties and Fines: Governments impose heavy fines on businesses that fail to comply with labor and payroll laws.

Legal Disputes: Employees may file lawsuits for violations of their rights, leading to costly legal battles.

Damage to Reputation: Non-compliance can severely damage a company’s reputation, leading to loss of clients and customers.

Business Integrity: Failure to follow laws damages the ethical foundation of a business, undermining trust and credibility.

Advantages of Statutory Compliance

The benefits of statutory compliance are significant:

Employee Retention: A compliant organization creates a positive working environment that encourages employees to stay long-term, reducing turnover and increasing productivity.

Protection Against Legal Action: Following laws shields businesses from potential lawsuits, fines, and other legal risks.

Improved Work Environment: Compliance fosters a sense of fairness, equality, and security among employees, contributing to a happier workplace.

How to Ensure Statutory Compliance for Your Organisation

Document All Policies & Procedures

Maintaining an employee handbook or policy manual that clearly outlines all compliance-related rules is crucial. This ensures both employees and employers are on the same page.

Stay Updated on Changing Acts and Policies

Laws and regulations frequently change. Businesses must stay updated with changes to labor laws and tax policies. Using payroll software that automatically updates in line with the latest legislation can help.

Conduct Regular Compliance Audits

Performing regular audits can help identify compliance gaps and ensure your organization is meeting all necessary legal requirements.

Train Employees

Regular workshops and training sessions ensure employees understand their rights and the company’s responsibilities, reducing the risk of non-compliance.

Statutory Compliance Checklist for Employers

To maintain compliance, employers must follow these statutory compliance checklist:

1. Industrial Relations Act (1947): For handling disputes between employers and employees.

2. Payment of Wages Act (1936): Ensures timely and correct wage payments.

3. Minimum Wages Act (1948): Guarantees minimum pay levels.

4. Employees Provident Fund (1952): Secures employees’ retirement funds.

5. Maternity Benefit Act (1961): Ensures women workers get maternity leave.

Statutory Compliance on Tax Liabilities

Tax Deducted at Source (TDS)

TDS is one of the key compliance areas for employers. Businesses must deduct taxes from employees’ salaries as per the prescribed rates and remit them to the government. Employers are also required to file TDS returns regularly.

Income Tax Compliance

Employers must also adhere to income tax slabs

How Quikchex HRMS Helps with Payroll Compliance

In today’s fast-paced business environment, managing payroll compliance can be challenging for companies of all sizes. With constantly changing labor laws, tax regulations, and employee benefits, it’s easy for businesses to fall behind or make errors. This is where Quikchex HRMS can make a significant difference.

Quikchex HRMS is a comprehensive human resource management system (HRMS) that simplifies the process of managing payroll compliance. It integrates seamlessly with the latest statutory compliance requirements, offering an automated solution that helps organizations stay compliant with minimal effort. Here’s how Quikchex HRMS can assist businesses in ensuring payroll compliance:

Automated Calculation of Statutory Deductions

One of the key aspects of payroll compliance is ensuring that the correct statutory deductions are made for each employee. Quikchex HRMS automates the calculation of various mandatory deductions such as Provident Fund (PF), Employee State Insurance (ESI), Professional Tax (PT), and Tax Deducted at Source (TDS).

The system is regularly updated to reflect the latest changes in tax laws and social security regulations, ensuring that businesses are always in line with current compliance standards.

Real-Time Updates on Legal Changes

Statutory laws related to payroll and employee welfare often undergo revisions. Keeping track of these changes manually can be a cumbersome task. Quikchex HRMS takes this burden off businesses by providing real-time updates on changes in labor laws, taxation, and employee benefits. Whether it’s the revision of minimum wages, updates to tax slabs, or new compliance requirements like the Employees’ Provident Fund (EPF) or Employees’ State Insurance (ESI), the platform ensures that businesses always stay compliant without having to manually monitor these updates.

Payroll Generation and Compliance Reports

Generating payroll that is fully compliant with statutory laws can be a time-consuming task. However, Quikchex HRMS automates the payroll process, ensuring accurate and timely generation of payslips for all employees. The system not only ensures that the correct deductions are made but also helps generate compliance reports for statutory audits.

Reports related to TDS, PF, ESI, and other statutory payments are generated automatically, allowing businesses to easily submit these reports to authorities or maintain them for internal audits.

Seamless Tax Filing and TDS Returns

Filing taxes and submitting TDS returns is a crucial part of payroll compliance. Quikchex HRMS simplifies this process by automatically calculating the TDS based on the income tax slabs for individual employees, accounting for exemptions, rebates, and deductions. The system generates TDS returns and helps employers file them seamlessly, ensuring that they comply with the Income Tax Act, avoiding penalties or fines.

Employee Benefits Management

Employee benefits such as Provident Fund (PF), Gratuity, and Maternity Leave are vital to ensuring compliance with labor laws. Quikchex HRMS makes it easy for businesses to manage these benefits by automating calculations and ensuring the accurate disbursement of benefits. The system also ensures that any changes in employee status (e.g., promotions, transfers, or terminations) are reflected in the benefits calculation, maintaining compliance at all times.

Integration with Government Portals

Quikchex HRMS integrates directly with various government portals, such as the EPF portal, ESI portal, and Income Tax Department, making it easy for businesses to remit statutory payments on time. Through these integrations, the system can directly upload challans, file returns, and make payments, reducing the chances of human error and ensuring the timely submission of contributions and taxes.

Audit Trail and Documentation

Maintaining accurate records and an audit trail is crucial for businesses in case of government inspections or audits. Quikchex HRMS automatically tracks all payroll-related transactions, ensuring that there is an easily accessible record of all compliance-related activities. From employee wage details to tax deductions and statutory payments, the system maintains a secure documentation trail that can be reviewed during audits or whenever necessary.

Customizable Compliance Settings

Every business has unique payroll needs depending on factors such as company size, location, industry, and employee classification. Quikchex HRMS offers customizable compliance settings to cater to specific organizational requirements. Whether your business operates in different states with varying labor laws or has specific payroll needs, Quikchex HRMS can be tailored to meet these requirements while ensuring compliance.

Employee Self-Service Portal

Quikchex HRMS offers an employee self-service portal that allows employees to access their payslips, check their statutory deductions, and view their social security contributions, such as PF and ESI. This transparency not only fosters trust between the employer and employees but also ensures that employees are aware of their compliance-related rights and benefits. Employees can raise queries, access tax-related information, and check their benefit status, improving the overall employee experience.

Conclusion

Payroll compliance can be a complex and time-consuming task for businesses, but with Quikchex HRMS, organizations can automate and streamline the entire process. From ensuring timely and accurate statutory deductions to maintaining up-to-date compliance with ever-evolving laws, Quikchex HRMS offers businesses a reliable solution to stay compliant with payroll regulations. By simplifying compliance, businesses can focus on their core operations, reduce the risk of legal issues, and build a positive work environment for employees.

FAQs

What are the main statutory compliance areas that Quikchex HRMS covers?

Quikchex HRMS covers key statutory compliance areas such as Provident Fund (PF), Employee State Insurance (ESI), Tax Deducted at Source (TDS), professional tax, maternity benefits, and more.

How does Quikchex HRMS stay updated with changing laws?

The system is regularly updated with the latest changes in labor laws, tax regulations, and social security policies, ensuring that your business always complies with the current legal requirements.

Can Quikchex HRMS help in tax filing and TDS returns?

Yes, Quikchex HRMS automates tax calculations and generates TDS returns, making it easier for businesses to file their taxes and remain compliant with the Income Tax Act.

Does Quikchex HRMS offer reports for compliance audits?

Yes, Quikchex HRMS generates detailed compliance reports related to statutory deductions, taxes, and employee benefits that can be used for audits and submissions to authorities.

Is Quikchex HRMS suitable for small businesses?

Absolutely! Quikchex HRMS is scalable and can be customized to meet the needs of businesses of all sizes, ensuring that even small businesses can easily maintain payroll compliance.