Income Tax Slabs and Rates – FY 2024-25, AY 2025-26

Introduction to Income Tax Slabs and Rates

Income tax slabs are the income brackets that determine the rate at which an individual’s income is taxed in India. For FY 2024-25 (assessment year 2025-26), there are two regimes: the new tax regime, which is simpler with lower rates and fewer deductions, and the old tax regime, which allows more deductions but may result in higher taxes for some. The new regime is the default, but you can opt for the old regime if it benefits you, especially if you have significant deductions.

New Tax Regime Details

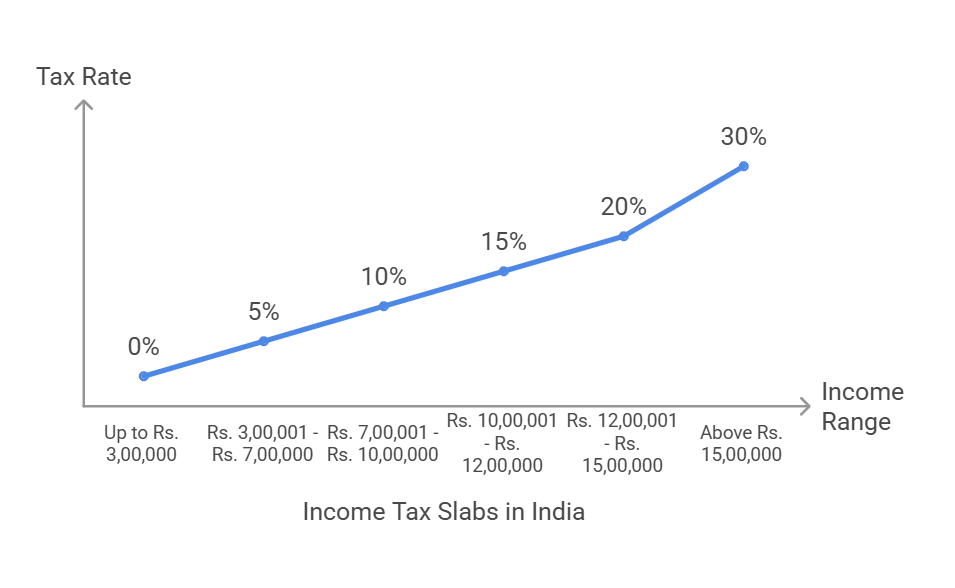

The new tax regime, effective from FY 2024-25, has the following slabs:

| Annual Income Tax Slabs | Income Tax Rates |

|---|---|

| Up to Rs. 3,00,000 | 0% |

| Rs. 3,00,001 – Rs. 7,00,000 | 5% |

| Rs. 7,00,001 – Rs. 10,00,000 | 10% |

| Rs. 10,00,001 – Rs. 12,00,000 | 15% |

| Rs. 12,00,001 – Rs. 15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% |

Key benefits include:

- A rebate under Section 87A of up to Rs. 25,000 for resident individuals with total income not exceeding Rs. 7,00,000, making it effectively tax-free (not applicable to NRIs).

- A standard deduction of Rs. 75,000 for salaried employees, increased from Rs. 50,000 in previous years, potentially saving up to Rs. 17,500 in taxes.

- Family pension deduction increased to Rs. 25,000 from Rs. 15,000.

- Deduction limit on employer’s contribution to the National Pension System (NPS) is 14% of salary, up from 10%.

- The highest surcharge rate is 25%, reduced from 37% as per Budget 2023 changes, applicable from April 1, 2023.

- The new regime is the default, and opting for the old regime requires filing Form 10-IEA (Income Tax Slabs for FY 2024-25 and AY 2025-26).

Old Tax Regime Details

The old tax regime, unchanged in Budget 2024, has age-based slabs:

| Income Slabs | Age < 60 years & NRIs | Age 60-80 years | Age > 80 years |

|---|---|---|---|

| Up to Rs. 2,50,000 | 0% | 0% | 0% |

| Rs. 2,50,001 – Rs. 3,00,000 | 5% | 0% | 0% |

| Rs. 3,00,001 – Rs. 5,00,000 | 5% | 5% | 0% |

| Rs. 5,00,001 – Rs. 10,00,000 | 20% | 20% | 20% |

| Rs. 10,00,001 and above | 30% | 30% | 30% |

Key features include:

- No changes were made to the slabs in Budget 2024, maintaining continuity from FY 2023-24.

- Surcharge and a 4% Health and Education cess are applicable on the tax liability.

- Rebate under Section 87A of Rs. 12,500 for income up to Rs. 5,00,000, making it tax-free for eligible residents.

- Offers various deductions under Chapter VIA, such as Section 80C (up to Rs. 1,50,000), 80D (health insurance), and HRA, which are not available in the new regime (Salaried Individuals for AY 2025-26 | Income Tax Department).

Choosing Between Old and New Tax Regimes

Research suggests choosing the new regime if you have fewer deductions, as it offers lower rates. For example, if you claim significant deductions under Section 80C or HRA, the old regime might be better. Salaried individuals can save up to Rs. 17,500 under the new regime due to the increased standard deduction.

The evidence leans toward the new regime for those with minimal deductions, while the old regime suits those with many claims. For non-business income, the choice can be made annually at ITR filing; for business income, it’s a one-time switch to the old regime (Income Tax Slab for FY 2025-26 and FY 2024-25 – New vs Old Tax Regime).

Comprehensive Analysis of Income Tax Slabs and Rates for FY 2024-25

This detailed analysis provides a thorough understanding of income tax slabs in India for the fiscal year 2024-25 (assessment year 2025-26), covering both the new and old tax regimes, comparisons, deductions, and practical considerations for taxpayers. The information is based on recent updates and official sources, ensuring accuracy as of March 12, 2025.

Introduction to Income Tax Slabs

- Income tax slabs are the income brackets that determine the rate at which an individual’s income is taxed. In India, the government introduced the new tax regime in 2020 under Section 115BAC, offering lower tax rates with limited deductions, while the old regime retains traditional slabs with more exemptions. For FY 2024-25, the new regime is the default, but taxpayers can opt for the old regime, especially those with business income, with specific conditions.

Fiscal and Assessment Year Context

- The fiscal year 2024-25 runs from April 1, 2024, to March 31, 2025, and corresponds to the assessment year 2025-26, where the income earned in FY 2024-25 is assessed for tax. This period is critical for taxpayers to understand their tax liabilities and plan accordingly, given the dual regime options.

Detailed Breakdown of New Tax Regime Slabs

The new tax regime, as per the Finance Act 2024 amendments, has the following slabs for FY 2024-25:

| Annual Income Tax Slabs | Income Tax Rates |

|---|---|

| Up to Rs. 3,00,000 | 0% |

| Rs. 3,00,001 – Rs. 7,00,000 | 5% |

| Rs. 7,00,001 – Rs. 10,00,000 | 10% |

| Rs. 10,00,001 – Rs. 12,00,000 | 15% |

| Rs. 12,00,001 – Rs. 15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% |

Key features include:

A rebate under Section 87A of up to Rs. 25,000 for resident individuals with total income not exceeding Rs. 7,00,000, making it effectively tax-free (not applicable to NRIs).

- A standard deduction of Rs. 75,000 for salaried employees, increased from Rs. 50,000 in previous years, potentially saving up to Rs. 17,500 in taxes.

- Family pension deduction increased to Rs. 25,000 from Rs. 15,000.

- Deduction limit on employer’s contribution to the National Pension System (NPS) is 14% of salary, up from 10%.

- The highest surcharge rate is 25%, reduced from 37% as per Budget 2023 changes, applicable from April 1, 2023.

- The new regime is the default, and opting for the old regime requires filing Form 10-IEA (Income Tax Slabs for FY 2024-25 and AY 2025-26).

Detailed Breakdown of Old Tax Regime Slabs

The old tax regime, unchanged in Budget 2024, has the following slabs, with variations based on age:

| Income Slabs | Age < 60 years & NRIs | Age 60-80 years | Age > 80 years |

|---|---|---|---|

| Up to Rs. 2,50,000 | 0% | 0% | 0% |

| Rs. 2,50,001 – Rs. 3,00,000 | 5% | 0% | 0% |

| Rs. 3,00,001 – Rs. 5,00,000 | 5% | 5% | 0% |

| Rs. 5,00,001 – Rs. 10,00,000 | 20% | 20% | 20% |

| Rs. 10,00,001 and above | 30% | 30% | 30% |

Key features include:

- No changes were made to the slabs in Budget 2024, maintaining continuity from FY 2023-24.

- Surcharge and a 4% Health and Education cess are applicable on the tax liability.

- Rebate under Section 87A of Rs. 12,500 for income up to Rs. 5,00,000, making it tax-free for eligible residents.

- Offers various deductions under Chapter VIA, such as Section 80C (up to Rs. 1,50,000), 80D (health insurance), and HRA, which are not available in the new regime (Salaried Individuals for AY 2025-26 | Income Tax Department).

Comparative Analysis of New vs. Old Tax Regimes

To help taxpayers decide, here’s a comparison of the slabs:

| Tax Slabs | Old Tax Regime Rates | New Tax Regime Rates |

|---|---|---|

| Up to Rs. 2,50,000 | 0% | 0% |

| Rs. 2,50,001 – Rs. 3,00,000 | 5% | 0% |

| Rs. 3,00,001 – Rs. 5,00,000 | 5% | 5% |

| Rs. 5,00,001 – Rs. 6,00,000 | 20% | 5% |

| Rs. 6,00,001 – Rs. 7,00,000 | 20% | 5% |

| Rs. 7,00,001 – Rs. 9,00,000 | 20% | 10% |

| Rs. 9,00,001 – Rs. 10,00,000 | 20% | 10% |

| Rs. 10,00,001 – Rs. 12,00,000 | 30% | 15% |

| Rs. 12,00,001 – Rs. 15,00,000 | 30% | 20% |

| Rs. 15,00,000 and above | 30% | 30% |

Key differences:

- The new regime has higher tax-free thresholds for lower incomes (up to Rs. 3,00,000 vs. Rs. 2,50,000 in the old regime for most).

- The old regime allows deductions like Section 80C and HRA, which can significantly reduce taxable income, while the new regime limits deductions to standard ones like Rs. 75,000 for salaried employees.

- Surcharge rates: Both regimes have surcharges (10% for income > Rs. 50 lakh and < Rs. 1 crore, 15% for > Rs. 1 crore and < Rs. 2 crore, 25% for > Rs. 2 crore and < Rs. 5 crore, 37% for > Rs. 5 crore), but the new regime’s lower base rates may offset this for some.

Deductions and Exemptions Available

New Tax Regime:

- Deductions not available include Section 80C (Rs. 1,50,000 for investments like PPF, ELSS), 80D (health insurance), HRA, and interest on self-occupied home loan (up to Rs. 2,00,000 under Section 24(b)).

- Available deductions: Standard deduction of Rs. 75,000, interest on let-out property, employer’s NPS contribution (14% of salary), family pension deduction of Rs. 25,000, and exemptions like voluntary retirement under Section 10(10C) (Income Tax Slabs for FY 2024-25 and AY 2025-26).

Old Tax Regime:

- Offers a wide range of deductions, including Section 80C, 80D, 80E (education loan interest), HRA, and interest on self-occupied home loan, making it suitable for those with significant investments or expenses.

Choosing Between the Two Regimes

The choice between regimes depends on individual circumstances:

- New Regime: Ideal for those with minimal deductions, as it offers lower tax rates and simplicity. For example, salaried individuals with no major investments may benefit, especially with the Rs. 75,000 standard deduction, potentially making income up to Rs. 7,75,000 tax-free with the rebate.

- Old Regime: Better for those who can claim substantial deductions, such as under Section 80C or HRA, which can lower taxable income significantly. For instance, if you invest Rs. 1,50,000 in PPF and claim HRA, the old regime might reduce your tax liability more.

- For non-business income, the choice can be made annually at ITR filing; for business income, it’s a one-time switch to the old regime (Income Tax Slab for FY 2025-26 and FY 2024-25 – New vs Old Tax Regime).

Additional Notes and Considerations

- Surcharge Rates: Apply for high incomes (> Rs. 50 lakh), with rates up to 37% for incomes above Rs. 5 crore, but the new regime caps at 25% for most, reducing effective rates.

- Cess: A 4% Health and Education cess is applicable on the tax liability plus surcharge in both regimes.

- Recent Updates: No mid-year changes to slabs for FY 2024-25 were found, confirming the stability of the current structure as per official sources like the Income Tax Department and financial portals (Salaried Individuals for AY 2025-26 | Income Tax Department).

- An unexpected detail: Proposed changes for FY 2025-26 include increasing the rebate under Section 87A to Rs. 60,000 for income up to Rs. 12,00,000, effective from AY 2026-27, but these are not yet applicable (Income Tax Slabs FY 2025-26 | AY 2026-27).

This comprehensive guide should assist taxpayers in navigating the complexities of income tax slabs for FY 2024-25, ensuring informed decision-making for tax planning.