Top 10 Best Expense Management Software in India

Many companies face problems with expense management when done manually. Mismanagement of payments like client-related mobile reimbursement, travel expenses, return filing charges, and many more end up burning a huge hole in the company’s finances. Fortunately, when traditional ways of managing expenses fail, expense management software is capable of achieving pinpoint accuracy.

A cloud-based expense management software can easily tackle all these problems by automating the process of recording, approving, and, most importantly, processing macro and petty expenses incurred by the organization. Let us take a look at the situations in which expense management software is needed in an organization before diving into the best expense management software in India.

What is Expense Management Software?

Expense management software is a tool that can streamline the whole reimbursement process. With the help of this software, firms can easily manage the expenses of their trip reservations, submit expenditure reports, accelerate reimbursements, receive notifications, and have a look at expenses in real time. To avoid all risks related to human cost management, implementing expense management software is essential.

Scenarios in which you might need Expense Management Software

1. Efficient Management of Employee Expenses:

For organizations to track and manage employee spending efficiently, expense management software is essential. Automating the submission and reimbursement of expenses helps businesses do away with human paperwork. With the help of this software, employees can quickly and conveniently enter expense information, add receipts, and submit expense reports. It ensures that all spending complies with company standards and budgets and promotes accountability and openness.

2. Improved compliance and audit readiness:

Businesses place high importance on adhering to internal audit guidelines and financial standards. Through the secure storage of spending information, receipts, and supporting documents, expense management software streamlines the compliance process. During audits, this centralized system makes it easier to retrieve expense records quickly and guarantees correct reporting. Companies may easily show compliance with internal policies and regulatory standards by establishing a thorough audit trail.

3. Effective Budget Planning and Control:

Budget planning and control heavily rely on expense management software. Examining spending patterns and trends gives firms the ability to create precise budgets. Companies can properly deploy resources and spot possible areas of overspending by collecting insights on consumer purchasing patterns. Managers are able to make data-driven decisions, optimize budgets, and match spending with strategic goals thanks to the reporting and analytics features of the program.

4. Streamlined Workflow and Productivity:

Processes for managing expenses manually can be time-consuming and error-prone. The entire process from cost submission to reimbursement is streamlined by using expense management software. Automated elements that save time and lighten administrative workloads include receipt scanning, expense categorization, and approval workflows. Employees and the financial teams can now concentrate on more strategic duties, increasing productivity overall.

5. Integration with Accounting Systems for Seamless Financial Management:

Businesses gain a lot from expense management software that connects with accounting systems. Companies may minimize manual data entry and lower the possibility of errors by smoothly sending spending data from the software to the accounting system. With this integration, accurate financial reporting is guaranteed, reconciliation procedures are made simpler, and the workflow for financial management as a whole is improved. It helps companies to view spending, cash flow, and financial performance in real-time.

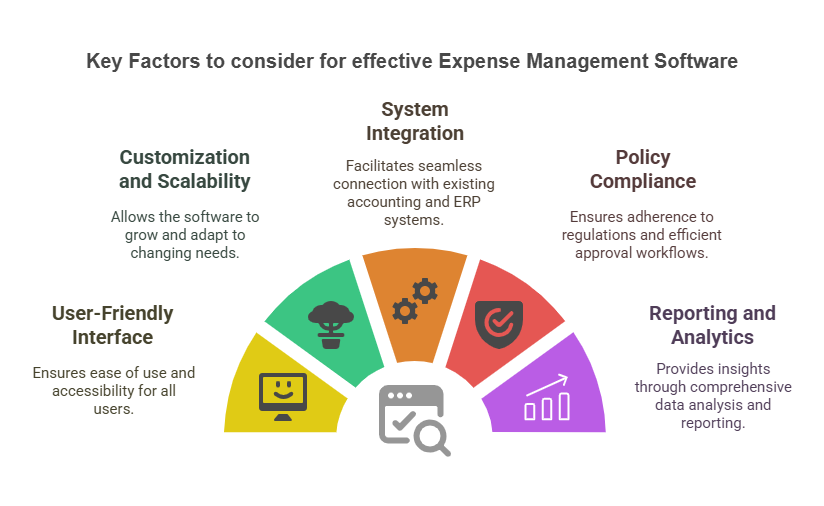

Few factors to consider when getting Expense Management Software

1. User-Friendly Interface and Accessibility:

The user experience and interface design are critical factors to take into account while assessing expense management software. The program should have an easy-to-use interface that makes it simple for users to traverse the system. It should also be used on a variety of devices, including PCs, laptops, tablets, and smartphones, to enable employees to submit expenditures easily while on the go.

2. Customization and Scalability:

Each organization has different needs for expense management. Consequently, it is crucial to pick a software solution that provides customization choices so that the system may be adjusted to your unique demands. You should be able to customize the software to reflect the procedures and regulations used by your organization by changing the expense categories, approval workflows, and policy compliance requirements.

3. Integration with Accounting and ERP Systems:

It is essential to choose an expense management software that works well with your current accounting and ERP systems to ensure a smooth data flow and reduce human data entry. Real-time synchronization of expense data is made possible by the integration, removing the need for double data entry and lowering the likelihood of mistakes. Additionally, integration makes it easier to create accurate financial reports that offer better insights into spending patterns and trends.

4. Policy Compliance and Approval Workflows:

Software for managing expenses must provide reliable features for policy compliance and adaptable workflows for approval. You should be able to specify expense policies and have them automatically verify cost claims. In order to provide adequate authorization and control, the system should also let you set up multi-level approval workflows based on spending criteria. Advanced features that further improve policy compliance and speed up the approval process include receipt capture, expense classification, and automated policy violation warnings.

5. Reporting and Analytics Capabilities:

Strong reporting and analytics features should be available in a complete cost management program. You should be able to get useful insights about cost patterns, categories, and trends using the software’s pre-built reports and dashboards. Additionally appealing are tools for customizable reporting that let you create custom reports to satisfy particular business needs. You may also find cost-saving opportunities, optimize spending allocation, and make wise financial decisions with advanced analytics capabilities like data visualization and predictive analytics.

Top 10 best Expense Management Software

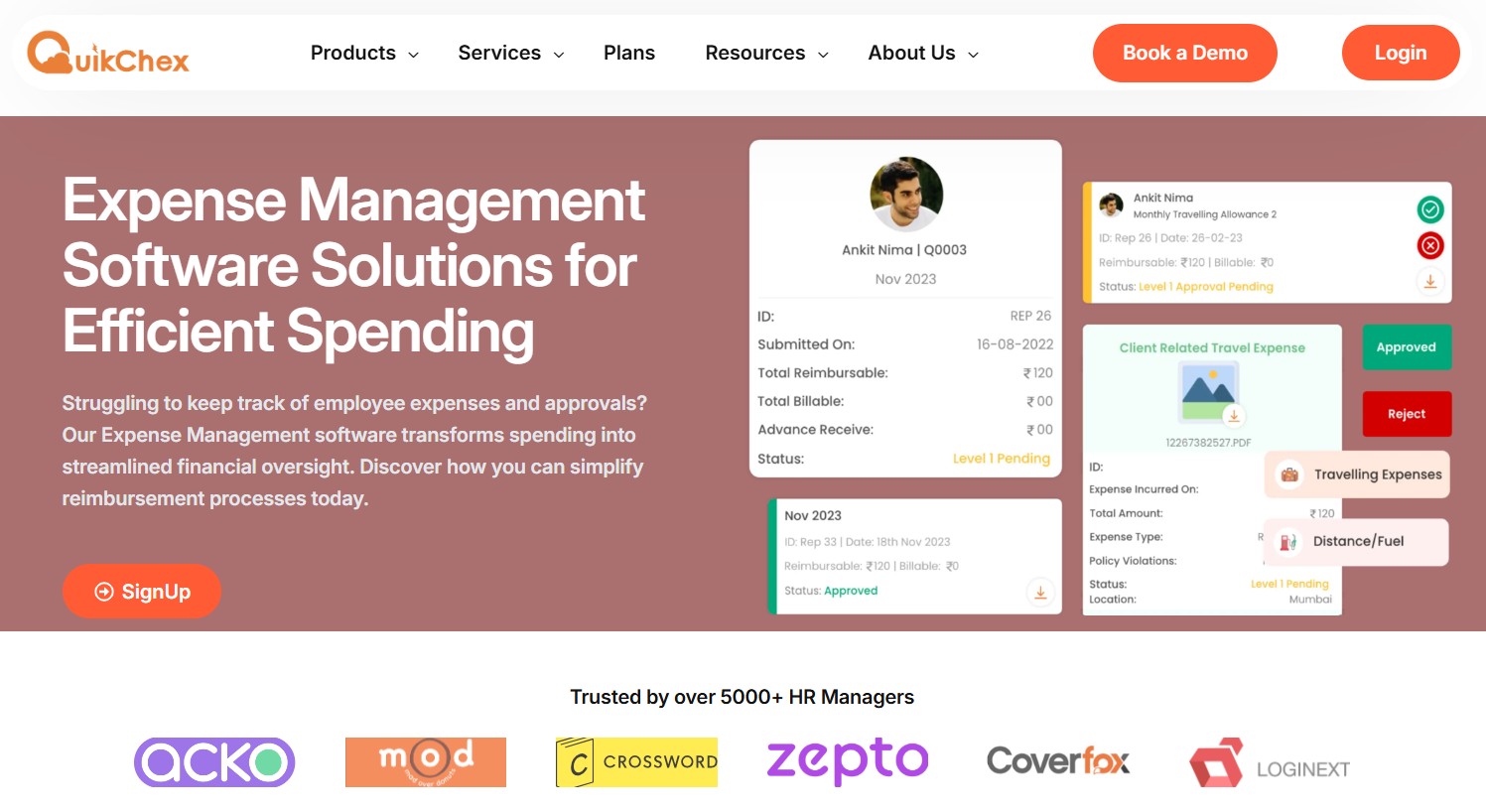

1. Quikchex

Quikchex simplifies and streamlines the entire expense management process. It offers a user-friendly interface where employees can easily submit their expenses and attach relevant receipts. One of the major factors that make Quikchex unique from every other expense-oriented option on the list is that along with the expense module, it also offers an end-to-end HRMS solution which makes it easier for companies to get an all-in-one complete software.

Pros:

- User-friendly interface and highly customizable for HR managers

- Offers one-stop HRMS along with expense management.

- Mobile and Web App for Expenses Submissions and Approvals

- Highly configurable with custom expense categories and ability to enforce company restrictions on category limits

- Affordable Pricing

Cons:

- Might not be suitable for a 20,000+ employee organization.

- Limited Global presence.

2. Zoho Expense

Zoho Expense is a leading expense management tool that has helped businesses manage the whole receipt-reimbursement process. It is available both as a web-based and mobile application and can be integrated with any current software you might have in your workflow system. Mainly it helps firms get crucial information about their company finances and avoid any mismanagement of expense submission and automation.

Pros:

- The credibility that Zoho as a brand holds.

- Integration with other products like Zoho books, Zoho People, etc.

Cons:

- Expense submissions with reports can be a complex task for employees.

- Not as configurable for mid-sized organizations

3. Expensify

Expensify is a expense management software company that offers expense management tools for business firms as well as personal use. It offers features like spend management, expense reports, company credit cards, invoicing, and many more. They offer physical and virtual cards to meet all your payment needs.

Pros:

- Easy to split expenses between departments.

- Integrates seamlessly with financial institutions, credit cards, and other payment modes.

Cons:

- The learning curve is steep, and it might take time for users to familiarize themselves with the features.

- Pricing is higher as compared to other competiors

4. SAP Concur

Sap Concur solutions merge all your travel expenses, reimbursements, and other expenses into one system. It helps firms get clear visibility into transactions and simplifies the process for everyone. They also have expense and travel products like concur expense, concur reports, travel, requests, and many more.

Pros

- Highly configurable, suitable for large enterprises

- Credibility of the SAP brand

Cons

- Expensive, especially for small and mid-sized businesses.

- Complicated and complex to set up

5. Fyle

The expenditure management program Fyle has a thorough expense feature that simplifies the entire expense reporting procedure. Users may quickly and easily gather receipts, categorize spending, and produce thorough expense reports with Fyle. It is simple to input expenses from numerous sources thanks to the software’s integration with many platforms and apps. The AI-powered technology used by Fyle guarantees precise expense categorization and minimizes manual data entry.

Pros:

- Clean and intuitive user interface

- Seamless integration with various accounting software and ERP’s.

Cons:

- Pricing can be on the higher side if advanced features are opted for.

- Customizations are very limited.

6. Happay

Happay is a comprehensive expense management platform that offers digital solutions for businesses to manage corporate spending, employee expenses, and reimbursements. The platform provides a cloud-based solution that aims to streamline expense tracking and reduce manual financial processes. By leveraging technology, Happay helps organizations gain better visibility and control over their corporate spending.

Pros

- Comprehensive spend management with corporate cards and expense tracking

- Real-time expense reporting and approval workflow

- Integration with multiple accounting and ERP systems

Cons

- Can be complex for smaller businesses with simpler expense needs

- Advanced features may require higher-tier pricing plans

7. ITILite

ITILite is an AI-based SAAS travel expense management software that lets organizations properly plan and book their trips while also giving recommendations and incentives so that the employees can make a smart move. One of the unique features of ITILite is that it predicts what your travel would generally cost and if you spend less than that it lets you keep part of it as a reward and also makes you cost-conscious.

Pros

- Great for companies that have employees who frequently travel for work

- Unified travel and expense solution is a unique value proposition

Cons

- Standalone expense solution, so additional integration still required with an HRMS solution

- Suited for travel related expenses, and not so much for other business expense categories

8. Paybooks

Paybooks is an HR and payroll management software that includes expense management features, targeting small to medium-sized businesses in India. The platform offers a comprehensive suite of workforce management tools designed to simplify administrative processes for growing companies. It provides an integrated approach to managing employee-related financial and administrative tasks, with a strong focus on the Indian business ecosystem.

Pros

- Integrated HR and payroll solution with expense management capabilities

- Mobile-friendly interface for easy expense submission

- Compliance-focused features for Indian businesses

Cons

- Limited global functionality, primarily focused on Indian market

- May lack advanced features compared to specialized expense management tools

9. QuickBooks

QuickBooks is a comprehensive accounting software that includes expense management features as part of its broader financial management solution. Developed by Intuit, the platform has become a go-to financial tool for businesses of various sizes, offering both cloud-based and desktop solutions. It provides a wide range of financial management capabilities that go beyond simple expense tracking, including invoicing, payroll, and detailed financial reporting.

Pros

- Robust accounting and financial tracking capabilities

- Seamless integration with banking and financial institutions

- Suitable for businesses of various sizes, from small businesses to enterprises

Cons

- Expense management is a feature within accounting software, not a standalone solution

- Can be overwhelming for users who need a simple expense tracking tool

- Pricing can be high for small businesses looking for basic expense management

10. Rydoo

A comprehensive and top-notch cost management system that streamlines the complete expense management procedure is available from Rydoo. Users may easily capture receipts, classify expenses, and submit expense reports while on the road with Rydoo. With the help of Rydoo’s smart scanning technology, receipt processing is accurate and doesn’t require manual data entry. The app also offers real-time expense tracking, enabling users to keep track of their spending and stick to their budgets.

Pros:

- Seamlessly integrates with popular accounting software.

- Superior travel management capabilities that integrate with expense reporting.

Cons:

- Might not be suitable for businesses searching for full expenditure management features because it just focuses on expense and travel solutions.

- Relatively higher pricing for the average small and medium sized business

Conclusion:

While there are a number of comprehensive expense management solutions in the market, it is important for all companies to decide what they are looking for specifically. Factors like budget, local support, complexity and user-interface are examples of what determines each company’s preference. Choosing the right expense management solution, can play a big role in eliminating expense leakages, creating high employee satisfaction and helping with budgeting decisions.

FAQs

How much does expense management software cost for Indian businesses?

Pricing for expense management software in India varies widely, typically ranging from ₹50 to ₹500 per user per month. Most providers offer tiered pricing models:

- Basic plans start around ₹99-₹199 per user monthly

- Mid-range plans cost ₹299-₹399 per user monthly

- Enterprise solutions can go up to ₹500+ per user monthly Many providers offer custom pricing for larger organizations and include scalable features based on company size and specific requirements.

What key features should businesses look for in expense management software?

Essential features for expense management software include:

- Receipt capture and OCR technology

- Automated expense reporting

- Integration with accounting systems

- Mobile app functionality

- Approval workflows

- Real-time expense tracking

- Compliance and tax reporting

- Corporate card management

- Detailed analytics and reporting

Are these expense management solutions compliant with Indian tax regulations?

Most top expense management software in India are designed to be GST-compliant and follow Indian accounting standards. They typically provide:

- Automated GST calculations

- Standardized invoice formatting

- TDS (Tax Deducted at Source) reporting

- Integration with Indian accounting software

- Compliance with the Income Tax Department’s e-invoice requirements Businesses should still consult with their financial advisors to ensure complete compliance with current regulations.

Can small businesses and startups use these expense management tools?

Yes, many expense management software options cater specifically to small businesses and startups in India:

- Offer affordable pricing plans

- Provide scalable solutions

- Offer basic versions with essential features

- Provide easy-to-use interfaces

- Support integration with popular accounting and banking platforms Some providers like Quikchex, Happay, Zoho Expense, and Fyle have specific packages designed for small to medium enterprises with flexible pricing and features.