Best Payroll Outsourcing Service Provider In Mumbai

As organizations grow, so do their payroll complexities. Factors such as an increasing workforce, diverse employee benefits, and ever-changing regulations can make payroll management challenging. This is where payroll outsourcing service providers become a valuable strategy, allowing companies to streamline their operations and mitigate risks associated with payroll processing. In today’s competitive landscape, businesses face numerous challenges related to payroll management. The increasing complexity of tax laws, employee benefits, and compliance requirements can overwhelm in-house HR teams. By outsourcing payroll, companies can mitigate these challenges and focus on their primary business activities, ultimately driving growth and enhancing employee satisfaction.

What is Payroll Outsourcing?

Payroll outsourcing is the practice of delegating the management of an organization’s payroll processes to an external service provider. This approach allows businesses to focus on their core operations while leveraging the expertise of specialized firms to handle complex payroll functions. From calculating salaries to ensuring compliance with tax laws, payroll outsourcing encompasses a wide range of services that can significantly enhance operational efficiency and accuracy.

Components of Payroll Outsourcing

Payroll outsourcing encompasses several key components that ensure comprehensive management of payroll functions.

- Payroll Processing: This is the core function of payroll outsourcing. It involves calculating employee salaries, managing deductions, and disbursing payments. Outsourced payroll providers utilize advanced software to ensure accurate calculations, reducing the likelihood of errors that could lead to employee dissatisfaction or compliance issues.

- Tax Compliance: Outsourcing payroll helps organizations stay compliant with federal, state, and local tax regulations. Payroll providers are well-versed in the complexities of tax laws and can handle all necessary tax filings, ensuring that companies avoid costly penalties for non-compliance.

- Employee Benefits Administration: Managing employee benefits, such as health insurance, retirement plans, and paid time off, can be complex. Payroll outsourcing firms often provide benefits administration services, ensuring that employees receive the appropriate benefits while minimizing the administrative burden on HR teams.

- Time and Attendance Management: Many payroll outsourcing companies offer time and attendance tracking solutions. These systems integrate with payroll processing to accurately record employee hours, manage leave requests, and calculate overtime, ensuring that payroll data is both precise and reliable.

- Reporting and Analytics: Outsourced payroll providers can generate detailed reports and analytics on payroll costs, employee hours, and tax liabilities. These insights can help organizations make informed decisions and identify trends that may impact their workforce and budgeting.

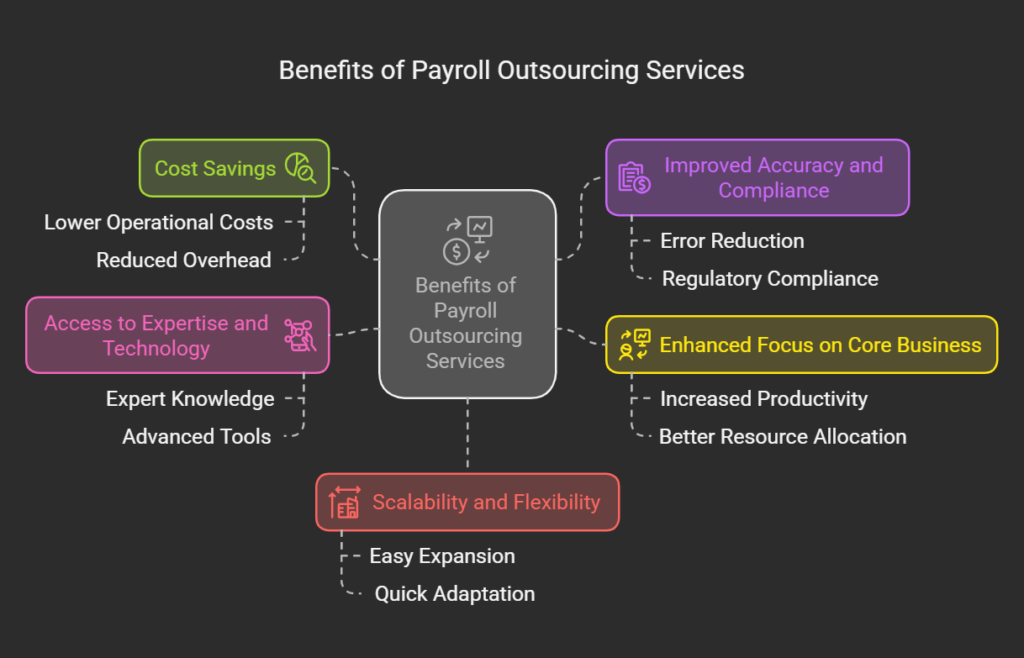

Benefits of Payroll Outsourcing Services

Outsourcing payroll offers numerous advantages that can significantly benefit organizations of all sizes.

1. Cost Savings

One of the most significant benefits of payroll outsourcing is cost savings. Maintaining an in-house payroll department can be expensive, considering the costs of best payroll software, staff training, and compliance updates. By outsourcing, companies can convert fixed costs into variable costs, allowing for better budget management.

2. Improved Accuracy and Compliance

Payroll processing errors can lead to severe consequences, including employee dissatisfaction and legal penalties. Outsourced providers specialize in payroll management, employing experts who understand the intricacies of payroll processing and compliance, resulting in fewer errors and enhanced accuracy.

3. Enhanced Focus on Core Business

Outsourcing payroll allows organizations to concentrate on their core competencies rather than getting bogged down in administrative tasks. This focus on strategic initiatives can lead to improved productivity and overall business growth.

4. Access to Expertise and Technology

Payroll outsourcing firms leverage the latest technology and industry expertise to deliver high-quality services. This access to advanced payroll systems and skilled professionals allows organizations to benefit from best practices without investing in expensive software or training.

5. Scalability and Flexibility

As businesses grow, their payroll needs can change. Outsourced payroll services offer the flexibility to scale operations easily, accommodating changes in workforce size and complexity without the need for significant internal adjustments.

Challenges of Payroll Outsourcing

While there are numerous benefits to payroll outsourcing, there are also challenges that organizations should consider.

Data Security Concerns

Outsourcing payroll involves sharing sensitive employee information with third-party providers, raising concerns about data security and privacy. Organizations must ensure that their chosen provider has robust security measures in place to protect confidential data.

Loss of Control

Outsourcing payroll can lead to a perceived loss of control over the payroll process. Organizations may feel less involved in day-to-day operations, which can create concerns about service quality and responsiveness.

Integration with Existing Systems

Integrating outsourced payroll services with existing HR and financial systems can be challenging. Organizations must ensure that their chosen provider can seamlessly connect with current software to avoid disruptions in data flow and reporting.

Communication Barriers

Working with an external provider may lead to communication challenges, particularly if the provider is located in a different time zone or country. Clear communication channels are essential to ensure smooth collaboration and timely resolution of issues.

Choosing the Right Payroll Outsourcing service provider

Selecting the right payroll outsourcing provider is crucial for maximizing the benefits of outsourcing.

Key Factors to Consider while choosing right Payroll outsourcing partner

1. Experience and Reputation: Look for a provider with a proven track record in payroll outsourcing and positive client testimonials.

2. Service Offerings: Ensure the provider offers a comprehensive range of services that align with your organization’s needs.

3. Technology: Evaluate the technology used by the provider, ensuring it is up-to-date and capable of integrating with your existing systems.

4. Customer Support: Reliable customer support is vital for addressing issues and ensuring smooth operations.

Questions to Ask Potential Providers

1. What security measures do you have in place to protect sensitive employee data?

2. How do you ensure compliance with changing tax laws and regulations?

3. Can you provide references from clients in similar industries?

4. What is your process for handling payroll discrepancies or issues?

5. How often will we receive reports, and what information will they include?

How Payroll Outsourcing Works

The payroll outsourcing process typically involves several steps:

1. Initial Consultation: The organization discusses its needs and objectives with the outsourcing provider.

2. Data Collection: The provider gathers necessary employee data, including hours worked, salaries, and benefits.

3. Payroll Processing: The provider processes the payroll, calculates taxes, and prepares payments.

4. Compliance Management: The provider ensures all payroll processes comply with relevant laws and regulations.

5. Reporting: The provider generates payroll reports and delivers them to the organization for review.

Payroll outsourcing can take various forms, listed below:

1. Full-Service Payroll: The provider handles all aspects of payroll processing, tax compliance, and reporting.

2. Partial Service: The provider manages specific payroll functions, such as tax filings or benefits administration, while the organization retains some control over payroll processes.

3. Technology-Enabled Solutions: Organizations can access cloud-based payroll software while outsourcing specific administrative tasks to a third-party provider.

Payroll Outsourcing in Different Industries

Payroll outsourcing can vary significantly across different sectors due to unique industry requirements.

Retail: Retail businesses often have high employee turnover and varying hours, necessitating robust time and attendance tracking and flexible payroll solutions.

Healthcare: Healthcare organizations face complex compliance requirements related to employee certifications and licensing, making specialized payroll services crucial.

Technology: Tech companies may prioritize payroll solutions that integrate with their existing HR and financial systems for seamless operations.

Future Trends in Payroll Outsourcing

As businesses continue to evolve, several trends are shaping the future of payroll outsourcing.

Technological innovations: advancements in technology, such as artificial intelligence and automation, are transforming payroll processes. Providers are increasingly adopting these technologies to enhance accuracy, efficiency, and reporting capabilities.

Changing Workforce Dynamics: The rise of remote work and gig employment is prompting organizations to reconsider their payroll strategies. Payroll outsourcing providers are adapting to accommodate diverse work arrangements and unique compensation structures.

Regulatory Changes: As labor laws continue to evolve, payroll outsourcing providers must remain vigilant to ensure compliance. Organizations will benefit from outsourcing partners that stay updated on regulatory changes and can adapt their services accordingly.

Why Quikchex is the Best Payroll Outsourcing Option in Mumbai

Local Expertise

Quikchex has a deep understanding of the Mumbai business landscape and its unique payroll requirements. With expertise in local labor laws and compliance, Quikchex ensures that businesses adhere to regulations, minimizing risks of legal issues.

Comprehensive Services

Quikchex offers a full suite of payroll outsourcing services, including payroll processing, tax compliance, benefits administration, and employee self-service portals. This comprehensive approach allows businesses to manage all payroll-related functions in one place.

User-Friendly Platform

The Quikchex platform is designed with user experience in mind. Its intuitive interface makes it easy for HR teams to navigate, ensuring smooth operations and quick access to necessary information.

Cost-Effective Solutions

Quikchex provides competitive pricing plans tailored to the needs of businesses in Mumbai. This affordability makes it accessible for small and medium-sized enterprises, allowing them to leverage high-quality payroll services without breaking the bank.

Advanced Technology

Utilizing cutting-edge technology, Quikchex automates many payroll processes, reducing the risk of errors and ensuring timely payroll processing. The platform also offers robust reporting and analytics tools for better decision-making.

Scalability

As businesses grow, their payroll needs change. Quikchex offers scalable solutions that can easily adapt to increasing employee counts and changing organizational structures, ensuring that businesses can grow without complications in payroll management.

Dedicated Customer Support

Quikchex prides itself on its excellent customer service. With a dedicated support team available to assist clients, any issues can be resolved promptly, ensuring seamless payroll operations.

Data Security and Compliance

Quikchex prioritizes data security with advanced encryption and compliance protocols. This focus on security ensures that sensitive employee information is protected, giving businesses peace of mind.

Customizable Solutions

Understanding that each business has unique needs, Quikchex offers customizable payroll solutions that can be tailored to fit specific requirements, whether it’s handling diverse employee types or integrating with existing systems.

Positive Client Testimonials

Quikchex has received numerous positive reviews from clients across various industries in Mumbai. These testimonials reflect the high level of satisfaction with their services and the impact on operational efficiency.

In summary, Quikchex stands out as the best payroll outsourcing option in Mumbai due to its local expertise, comprehensive services, advanced technology, and commitment to customer satisfaction. By choosing Quikchex, businesses can effectively manage their payroll processes and focus on their core operations, driving growth and success.

Conclusion

Quikchex emerges as the premier payroll outsourcing option in Mumbai, offering a unique blend of local expertise, comprehensive services, and advanced technology tailored to the needs of businesses. With its commitment to data security, cost-effectiveness, and exceptional customer support, Quikchex not only simplifies payroll management but also allows organizations to focus on their core operations. By partnering with Quikchex, businesses can navigate the complexities of payroll processing with confidence, ensuring compliance and enhancing overall efficiency. This strategic move ultimately contributes to better organizational growth and employee satisfaction.

FAQs

What specific payroll services does Quikchex provide?

Quikchex offers a range of payroll services, including payroll processing, tax compliance, employee benefits administration, attendance tracking, and detailed reporting.

How does Quikchex ensure compliance with local labor laws?

Quikchex stays updated with current labor laws and regulations in Mumbai, ensuring that all payroll processes adhere to legal requirements to minimize risks for businesses.

Is Quikchex suitable for small businesses?

Yes, Quikchex offers scalable and cost-effective solutions that cater to the needs of small and medium-sized enterprises, making it an ideal choice for businesses of all sizes.

How secure is my data with Quikchex?

Quikchex prioritizes data security with advanced encryption methods and strict compliance protocols, ensuring that sensitive employee information is well protected.

What support can I expect from Quikchex?

Quikchex provides dedicated customer support, offering assistance with any issues or questions that may arise, ensuring a smooth payroll process for clients.

Can Quikchex integrate with existing HR systems?

Yes, Quikchex is designed to integrate seamlessly with existing HR and financial systems, providing a cohesive solution for managing payroll and related functions.

How does Quikchex handle payroll discrepancies?

Quikchex has established procedures for addressing payroll discrepancies, ensuring that any issues are resolved quickly and accurately to maintain employee trust.

What are the costs associated with using Quikchex?

Quikchex offers competitive pricing plans that vary based on the specific services used and the size of the business, making it accessible for organizations with different budgets.

How often does Quikchex process payroll?

Quikchex can accommodate various payroll frequencies, whether weekly, biweekly, or monthly, based on the preferences and needs of the business.

How can I get started with Quikchex?

Getting started with Quikchex is easy! Interested businesses can contact their team for a consultation to discuss specific needs and explore suitable solutions tailored to their requirements.