Top 10 Best Payroll Software For SMEs In India

Payroll is the process of dispersing salaries to employees in a timely and orderly manner. But payroll is not just limited to payments of salaries but a complex process, right from creating payroll policies and CTC structures to depositing dues like PF, ESCI, and other compliance filings with the respective authorities. Companies with an inefficient payroll process run the risk of dispersing delayed and inaccurate salaries, legal issues, and hampering overall productivity due to employee dissatisfaction. Before checking out the best payroll software in the market, let us understand what pointers are essential to consider.

Can a Company Run Its Payroll Manually?

Although Indian payroll is complex, many companies run their payroll in-house through excel or some other accounting tool. A growing startup with a team of 10 to 20 members can run its payroll using the methods mentioned above but may still need payroll experts to get all the calculations and deductions right and this comes at a heavy cost. Hence running payroll manually is not scalable and susceptible to human errors.

Here are some concerning facts and figures about payroll processing

- 25% of small businesses use pen and paper to track finances, and 45% don’t have their own accountant or bookkeeper (Source: Clutch)

- 49% of workers will start a new job search after experiencing only two problems with their paycheck (Source: The workforce institution of Kronos)

- Non-submission of income tax returns as required under section 139, subsection (1) of the Income Tax Act can result in a penalty of Rs 5000 or more. (Source: TOI Business)

Evaluation criteria when choosing the best payroll software for you

1. Is the Payroll Software compatible with your payroll policies?

Policies and payroll components differ from organization to organization. You may require a tool just for basic and variable calculations of your employees or you may be looking for a comprehensive system that can be customizable according to your complex payroll policy workflows. We highly recommend that you verify whether your payroll software can cater to all your requirements effectively to avoid any manual interventions thereafter.

2. Does it offer advanced payroll features that scale with you?

Most payroll software has all the standard features like automated payroll calculations, employee self-service portals and payslip generation to name a few. But a detailed evaluation is needed to understand some more niche features like Flexi benefits, Loans and Advances, Flexi-CTC baskets and off-cycle payroll. Such features offer tangible benefits from tax savings for employees, to greater flexibility with your payroll process.

3. Can the Software manage all Statutory Compliance and Tax calculations?

According to government research, around 21% of HR and Payroll Managers find it difficult to stay afloat in filing TDS, PF, ESIC, LWF, and Professional Tax accurately. Failure in filing all necessary compliances can lead to legal risk and hefty fines to be paid. To ensure a safeguard from these problems, you need to make sure that your payroll software can process all compliance-related calculations and provide you with a team of compliance experts to do all necessary filings can be considered a huge plus.

4. Is it part of an integrated full-suite HRMS platform?

Payroll as a function, is highly dependent on a number of inputs from a company’s HRMS platform, from an updated employee master, to attendance and leave inputs. Without an integrated HRMS platform, running payroll becomes a cumbersome manual process, susceptible to errors.

5. What does the Implementation process look like?

Even the best payroll software vendors may take anywhere between 3 days to a 3 months to implement their system in your organization. Decision-makers must understand the implementation process and data migration requirements before finalizing the software. We would recommend you request a test run with your payroll software vendor to test the feasibility of the tool before using the solution at full capacity.

6. What is your Budget?

Payroll software range in price from Rs 50/- per employee per month to Rs.300/+ – per employee per month (usually with a base floor rate). Your requirements and employee strength will be one of the most important factors in determining the budget for your next Payroll Software.

7. Is the customer service reliable?

Having a highly responsive and proactive after-sales service is essential for any HR and Payroll software platform. An account manager with an ‘on demand’ direct phone call access comes in handy more often than you might think. Dedicated account managers assist you with any inquiry or issues that require immediate attention.

8. Is your data secure?

Data security is more important now than ever. Your payroll software will contain sensitive information about your company and employees’ salary info in form of official documents stored by the payroll team. Any compromise with the integrity of this data can lead to major consequences. Hence, the credibility of the payroll software is something that you should research by checking ISO certifications, other equivalent ratings, and reviews on third-party websites.

Now that you know exactly what to look for in a Payroll Software Application. Let’s check the 10 Best Payroll Software Solutions that should be on your Shopping list.

Top 10 Best Payroll Software For SMEs In India

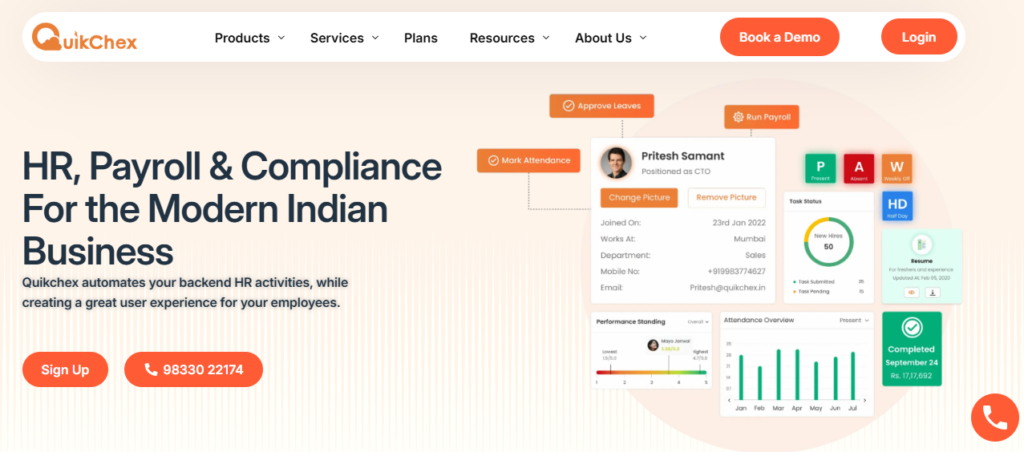

1. Quikchex

Quikchex is an easy-to-use, yet highly configurable and affordable HRMS designed to cater to Indian Payroll needs. It has a market standing of over 40 years in the HR tech and staffing industry and is one of the fastest-growing Payroll solutions companies in India, catering to hundreds of small and mid-sized businesses.

What is unique about Quikchex, relative to other payroll software solutions in the market, is that it offers a full-suite HRMS that integrates with their payroll, as well as a complete payroll outsourcing solution, that includes PF, ESIC, Professional Tax, and Salary TDS Management.

Their payroll software module is highly scalable, with a UI simple enough to work for 20-employee startups, yet configurable enough to accommodate 5000+ employee companies as well, with advanced features like Flexi-Benefits, Loans, and Advances, etc.

Moreover, every client has a dedicated Account Manager, who provides clients with payroll advisory support related to tax, compliance, or salary structures.

Quikchex Payroll Features Include:

- Easy-to-use user interface

- Integration with in-house attendance, leave, and full-suite HRMS

- Custom payroll cycles, allowances, deductions, and CTC structures

- Ability to process arrears, variable allowances, loans, advances, and Flexi-benefits

- Comprehensive tax declaration and investment proof submission portal

- User-friendly employee self-service (ESS) portal (Mobile + Web) to view payslips, tax calculations, and Form 16s

- Ability to generate custom payslips, full & final (FNF) statements, and salary reports

- Automated TDS calculation based on investment declaration

- Dedicated account manager for payroll outsourcing support and tax/compliance advisory

- Reports & analytics

- Integrated expense management

Pros:

- Easy-to-use yet highly configurable software

- Integration with Quikchex HRMS

- Cloud-based solution

- Automated statutory compliance

- Add-on payroll outsourcing and compliance management services

- Dedicated account manager for round-the-clock support

Cons:

- Niche modules for Learning & Development (L&D) and Rewards & Recognition (R&R) are not available

- Limited customization for highly complex payroll structures

Suitable for:

- Small, mid, and large-sized companies

- Businesses looking for an integrated payroll and compliance solution with outsourcing support

2. GreytHR

Image Source: GreytHR

GreytHR has been in the industry for more than 25 years and has built expertise in Payroll and HR Management over these years. GreytHR also enjoys credibility in the industry with thousands of customers in India. They offer a comprehensive HR solution that enables users to manage and quickly access employee data and reports.

GreytHR Features Include:

- Complete automated payroll processing

- Configuration of complex salary structures

- Automated payroll inputs and payslips

- Biometric, geo-fencing, and face-recognition attendance tracking

- Comprehensive overtime and shift management

- Customizable leave tracking

- Employee self-service (ESS) web and mobile-based portal

- Payroll and statutory compliance calculations

- Reports & analytics

- Integrated expense management

Pros:

- Easy to use

- Long-standing presence in the industry

- Cloud-based solution

- Automated statutory compliance

- User-friendly interface

Cons:

- Modules like Performance Management System (PMS) and recruitment are not available

- No payroll or compliance management solution (filing and inspections need to be handled separately)

- Limited customization for larger companies

- Feature limitations for advanced HR requirements

Suitable for:

- Small to mid-sized companies

3. PocketHRMS

Pocket HRMS has established itself as a comprehensive HR and payroll software solution. It offers a range of features that streamline HR processes, focusing on automating payroll, attendance, and compliance. The platform is designed for small to medium-sized businesses and has evolved over the years to meet the growing demands of the HR industry. Pocket HRMS provides an easy-to-use, cloud-based interface and integrates with other third-party tools for seamless operations. The solution covers essential HR tasks including payroll processing, statutory compliance, attendance management, and more.

Pocket HRMS includes:

- Automated Payroll Processing:

- Compliance Management:

- Salary Slip Generation:

- Reports & Analytics:

Pros:

- User-Friendly Interface:

- Automated Statutory Compliance:

- Cloud-Based Solution:

- Employee Self-Service:

- Integrated Expense Management:

Cons:

- Limited Customization for Larger Companies

- Feature Limitations for Advanced HR Requirements

- Support Delays

Suitable for:

Small to medium-sized businesses

4. Razorpay Payroll

Image Source: RazorPay

Starting as a gateway provider and neobank provider in 2015, Razorpay has gained the trust of users in the banking industry. Recently, through the acquisition of Opfin, they entered the payroll market. Razorpay offers a complete automation solution for auto dispersion of payroll, taxes, and compliance calculations. It is built for startups with a simple requirement and modules of Razorpay are limited to payroll, compliance, and attendance tracking.

RazorpayX Payroll Includes:

- Complete automation in payroll processing

- Automated PF, ESIC, and PT compliance calculations

- Automatic bifurcation of CTC, Allowances, HRA, etc.

- Seamless Slack Integration

- Basic attendance and leave tracking system

- Letter generation system

- Monthly and quarterly TDS calculation

- Auto disbursement of salaries

- Salary slip generation

- Reports & analytics

Pros:

- Auto disbursement of payroll and compliance payments

- Slack Integration available

- Cloud-based solution

- Employee self-service portal

- Integrated expense management

Cons:

- Not ideal for 50+ employee companies due to limited configurability

- Not ideal for companies looking for a complete HRMS solution

- Limited customization for larger companies

- Feature limitations for advanced HR requirements

- Possible support delays

Suitable for:

- Small-sized startups

- Small to medium-sized businesses

5. Keka

Keka is a comprehensive HR software platform designed to streamline various HR processes including payroll, performance management, recruitment, and compliance. It offers an intuitive and scalable solution suitable for businesses of all sizes, from startups to large enterprises. Keka’s cloud-based platform integrates seamlessly with other tools and provides features such as automated payroll processing, leave and attendance tracking, and performance appraisals. Its user-friendly interface and robust analytics make it a popular choice for organizations looking to improve HR efficiency and employee experience. Keka is designed to adapt to the growing needs of businesses, making it a versatile solution for both small and large teams.

Keka includes:

- Automated Payroll Processing

- Statutory Compliance Management (PF, ESIC, PT, TDS, etc.)

- Leave and Attendance Management

- Performance Management

- Recruitment and Onboarding

Pros:

- Highly customizable for different business needs

- Comprehensive HR features beyond payroll (performance, recruitment, etc.)

Cons:

- Can be expensive for smaller businesses

- Limited to India-specific statutory compliance

Suitable for:

- Mid to large-sized businesses

6. ZOHO Payroll

Image Source: ZohoPayroll

Zoho Payroll is a global brand in the HR Industry trusted by companies around the world. They offer an end-to-end payroll and HRMS solution with integration and customization options to their users. However, given its target market, it may not be ideal for companies looking for a local payroll software vendor and may not offer certain functions tailored toward Indian companies.

Zoho Payroll Features Include:

- Automated payroll, TDS, and compliance calculations

- Premium UI experience and user-friendly ESS portal

- Third-party integrations available

- Payroll approval workflows

- Payroll and compliance reports

- Salary slip generation

- Reports & analytics

Pros:

- Integration with other Zoho products like Zoho Books, Zoho People, etc.

- Strong market presence of Zoho

- Cloud-based solution

- Employee self-service portal

- Automated statutory compliance

Cons:

Zoho’s HRMS is a separate solution, requiring additional integration and costs

- No payroll or compliance management solution (filing and inspections need to be done manually or through another vendor)

- Not very configurable for complex payroll scenarios (e.g., Flexi-benefits management)

- Limited customization for larger companies

- Possible support delays

Suitable for:

- Mid to large-sized companies

- Small to medium-sized businesses looking for Zoho ecosystem integration

7. HROne

HROne is a cloud-based HRMS platform designed to simplify and automate HR operations, especially for small and medium-sized businesses. It offers a comprehensive suite of tools to manage payroll, compliance, attendance, recruitment, performance, and more. With a focus on user experience and automation, HROne enables HR teams to reduce administrative overhead, ensure statutory compliance, and enhance employee engagement. The platform’s scalability and flexibility make it suitable for a wide range of industries, aiming to provide an all-in-one HR solution with easy integration options and data-driven insights.

HROne includes:

- Automated Payroll Processing

- Statutory Compliance Management (PF, ESIC, PT, TDS, etc.)

- Leave and Attendance Management

- Employee Self-Service Portal

- Recruitment and Onboarding

Pros:

- Comprehensive HR Features

- User-Friendly Interface

- Automated Compliance

- Scalable Solution

- Customizable Reporting

Cons:

- Limited Advanced Features for Larger Enterprises

- Higher Cost for Small Businesses:

Suitable for:

Small to medium-sized businesses

8. Kredily

Image Source: Kredily

Kredily has recently stepped into the Payroll Software Industry targeting small to medium-sized businesses. They offer a ‘freemium’ plan to its users with limited functionality and is good for companies below 25 employees max data storage offered in this plan is 250MB. Any additional functions in this plan are chargeable. They also provide a payout gateway solution known as ‘KREDPAY’ which is a plus for companies looking for a direct payment solution for salary disbursements.

Kredily Features Include:

- Freemium plan with limited functionality

- Customizable salary structure

- Bank integration for salary payouts

- Bank transfers from ‘KREDPAY’

- PF, ESIC, PT, and TDS compliance calculations

- Automated payslip generation

- Real-time biometric integration

- Expense and leave workflow management

- Reports & analytics

- Employee self-service portal

Pros:

- Dedicated features like ‘KREDPAY’ for direct salary transfers

- The basic plan is affordable

- Cloud-based solution

- Automated statutory compliance

- Integrated expense management

Cons:

- Free plans limit the user database to 250MB, which is not suitable for even small companies

- Lack of a complete HRMS solution

- Basic features are offered as chargeable add-ons

- No payroll or compliance management solution (filing and inspections need to be handled separately)

- Limited customization for larger companies

- Possible support delays

Suitable for:

- Small to mid-sized companies

- Businesses looking for a basic payroll solution with direct salary transfers

9. Facto HR

FactoHR is a comprehensive, cloud-based HRMS platform tailored for organizations of all sizes. It offers features for automating payroll, attendance, leave management, and performance tracking. Designed to streamline HR processes and ensure statutory compliance, FactoHR helps businesses enhance efficiency, reduce manual errors, and improve employee experience. The platform also integrates seamlessly with other enterprise tools, making it adaptable for businesses with varying needs.

FactoHR includes:

- Automated Payroll Processing

- Statutory Compliance Management (PF, ESIC, PT, TDS, etc.)

- Leave and Attendance Management

- Employee Self-Service Portal

- Recruitment and Onboarding

- Performance Management

- Expense Management

Pros:

- Comprehensive HRMS Features

- Automated Compliance

- User-Friendly Interface

- Mobile App for Convenience

- Customizable Payroll and Leave Policies

Cons:

- Pricing Can Be High for Smaller Businesses

- Integration with External Tools Can Be Complicated

Suitable for:

- Small to medium-sized businesses

10. sumHR

SumHR is a user-friendly HRMS platform aimed at simplifying HR operations, especially for startups and small to mid-sized businesses. It focuses on automating payroll, attendance management, and employee self-service, offering an easy-to-use interface for HR teams and employees. SumHR’s cloud-based system is designed to provide a seamless and efficient experience with features for performance management, leave tracking, and compliance.

SumHR includes:

- Automated Payroll Processing

- Statutory Compliance Management (PF, ESIC, PT, TDS, etc.)

- Leave and Attendance Management

- Employee Self-Service Portal

- Recruitment and Onboarding

- Performance Management

Pros:

- Simple and Easy-to-Use Interface

- Affordable Pricing for Small Businesses

- Automated Payroll and Compliance

- Employee Self-Service Features

- Mobile App for Convenience

Cons:

- Limited Advanced Features for Larger Companies

- Limited Integrations with Other Tools

- Reporting Features Could Be More Robust

Suitable for:

- Startups and small to medium-sized businesses

Conclusion:

There are several excellent payroll software solutions available in India today. When selecting the right one, it’s essential to consider factors like cost, features, customer support, integration capabilities, and whether they offer comprehensive payroll management services. Since payroll and HRMS systems often work in tandem, we also recommend checking out our recent article on the Best HRMS Software in India to make a more informed decision.

Still unsure? Feel free to reach out to our experts at +919833022174 for a detailed consultation and find the best solution for your business. Or you can Book a Demo