Top 10 Payroll Outsourcing Companies in India

Payroll is an integral part of any business, so it’s crucial to get it right. Companies with a flawed or inefficient payroll system may fall into legal issues, fines, and employee dissatisfaction, which can drastically affect productivity. Although running payroll in India can be complex, many companies choose to run their payroll in-house, but at a potentially heavy cost.

Why should you Outsource your Payroll?

What is Payroll Outsourcing?

Payroll Outsourcing is when an organization uses a third-party payroll provider to handle their entire payroll and compliance-related activities. This includes:

1. Generation of certain payroll inputs like loss-of-pay deductions, overtime, arrears, and bonus calculations

2. Processing of payroll inputs to calculate the net salary payable, as well as deductions like Salary TDS, Provident Fund, ESIC, and Professional Tax

3. Filing of TDS and Compliance Returns

4. Generation of Reports and Payslips that are accessible to employees on self-service portals

5. Audit and Advice related to tax and compliance matters

According to Forbes Advisor Today, more than 70% of the 500 Largest Companies outsource their payroll, and it is no surprise, that a growing proportion of small and mid-sized companies are also following this trend.

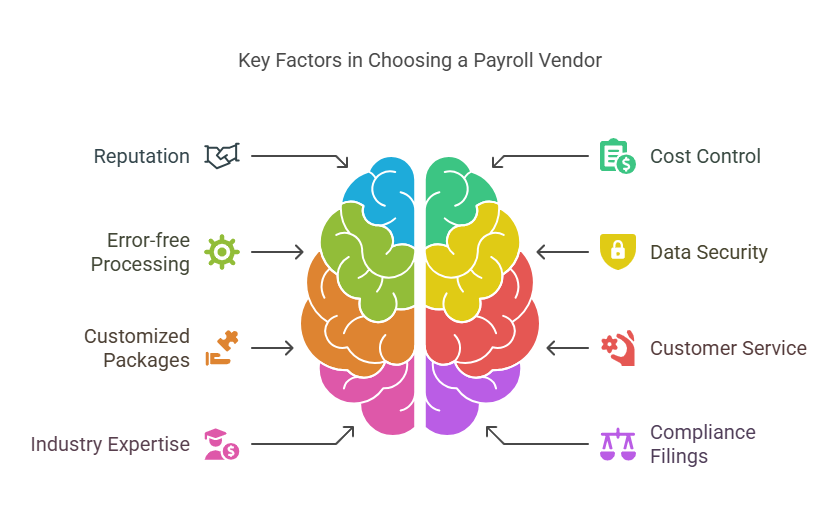

What should you look for in a Payroll Vendor?

1. Reputation in the market

The most important aspect to consider while evaluating payroll providers in India is the reputation and trust they build in the market. Companies gain a reputation in the industry by maintaining excellence in all the points below, like timely delivery, accurate processing, years of industry experience, and much more.

2. Cost Control

The cost you pay for outsourcing your payroll to a third-party vendor will be a fraction of the cost you would spend on an entire payroll team in-house. However, comparing various costs across vendors and researching any hidden costs involved can be crucial for deciding on the right vendor for you.

3. Error-free and timely processing

Error-free payroll processing and on-time delivery can reflect positively on the quality of the service given by a payroll provider in India. If possible, it is highly recommended to run a pilot payroll before opting for the service, as it will give you a clear understanding of whether that vendor can fulfill all your requirements or not.

4. Data security

The first thing that comes to our minds when we hear of a cloud-based solution is: where will the data be stored, and is it really secure? You must check for various security certifications (such as ISO-27001) that vendors have under their belts, and also validate the stability and security of their systems.

5. Customized package option

Ideally, it helps if your payroll service provider, is also your HRMS provider, given the need for tight integration between your HRMS and Payroll. Working with a Payroll Provider, who also has its own HRMS, reduces the costs and time spent on integration while being a one-stop solution for all your HR operational requirements.

6. Customer service

After-sales service is an essential component of any solution. Your employee will expect to receive their pay on time every month. It does not matter how you do it or what difficulties you may have to go through, but if your payroll vendor cannot assist you with issues and queries that need immediate attention at the time of running your payroll, you may want to explore other vendors who can provide you with this kind of support.

7. Industry expertise

Payroll outsourcing companies in India operate on efficiency and trust, both of which are obtained from years of experience in the field. Experienced payroll service providers provide you with a strong team of payroll experts who know the ins and outs of the payroll landscape.

8. Compliance filings

Payroll and compliance management go hand in hand, and adhering to all statutory compliances and their filings is a challenge most companies cannot overcome. Non-compliance can lead to heavy penalties. Hiring a separate compliance consultant leads to gaps in the process and requires one more party to deal with. Hence, companies find it more efficient to outsource their compliance to their current payroll service provider.

Now that you know exactly what to look for in a payroll outsourcing solution, let’s check out the Top Payroll Outsourcing Companies in India that exist in the market today.

Top 10 Payroll Outsourcing Companies

1. Quikchex

Quikchex is a one-stop Payroll solution designed to comply with the Indian payroll landscape. Through its group companies, it has a market standing of over 40 years in the Payroll, HR, and Staffing industries. Today, more than 1,200+ clients across PAN India trust their payroll with Quikchex, ranging from large MNC companies to some of the leading VC-backed tech startups.

What is different about Quikchex, relative to other payroll outsourcing companies, is that it not only provides comprehensive payroll outsourcing services to Indian companies but also offers clients an easy-to-use full-suite HRMS, end-to-end tax management and statutory compliance solution covering PF, ESIC, Professional Tax, LWF, Shops and Establishment, Minimum wages, etc.

Some other highlights of the solution include services like investment proof verifications, Form 16 generation, Payslips accessible by employees on self-service portals (including their mobile app), and dedicated account management support for any queries and issues that clients might have that need immediate resolution.

What makes Quikchex really unique is that it provides this arguably hard-to-find package at a price that is accessible for most SMEs and enterprise clients.

Pros:

✔️ Provides a unique package of a one-stop, full-suite HRMS, end-to-end payroll outsourcing, Salary TDS management, and Payroll and Labour Compliance management services.

✔️ Dedicated account manager support with a ‘maker-checker’ system in place

✔️ A budget-friendly option with long-standing in the industry.

Con:

❌Not ideal for companies looking to outsource payroll for international locations, as the solution currently only caters to India, Singapore, and Middle East markets.

2. ADP

ADP, or Automatic Data Processing, is a leading global payroll service provider, headquartered in the US, having made their entry into India a couple of years ago. They offer a range of products classified based on employee strength and global presence.

ADP can meet all your payroll and compliance requirements with additional functions like “Smart Compliance” and an automated live payroll and compliance track. ADP is also regularly updated on its compliance legislation globally. Most importantly, ADP is pricier compared to other options on this list and may not be suitable for small to mid-sized companies.

Pros:

✔️ Global Expertise – ADP offers international payroll solutions with compliance support across multiple countries.

✔️ Scalability – Suitable for startups and enterprises alike, with flexible service models.

Con:

❌ Expensive for Small Businesses – ADP’s pricing may not be cost-effective for startups or small enterprises

3. PaySquare

Ever since its inception in the early 2000s, Paysquare has been on the list of the growing payroll outsourcing companies in India. Paysquare today offers comprehensive outsourcing solutions in the payroll and accounting domains. Due to its expertise in payroll and account consulting, Paysquare has created a niche for itself in these domains of the market. However, it does not have its own HRMS solution, which may not be suitable for companies looking for a one-stop integrated solution.

Pros:

✔️ User-Friendly Self-Service Portal – Employees can access payslips and tax documents with ease.

✔️ Strong Compliance Support – Helps businesses stay compliant with payroll laws.

Con:

❌ Limited HRMS Features – Does not offer comprehensive HR management functionalities

4. Excelity Global (now Dayforce)

Excelity Global is a payroll processing, compliance administration, and human capital management service provider with over 400+ clients across 17 countries in the Asia-Pacific region including India. Along with Payroll Outsourcing and compliance services, they also provide basic Payroll solutions and an Employee self-service portal for your employees to check payslips, mark attendance, etc. They also provide seamless integration options with most HRMS Software that are popular in the industry. However, it is worth noting that it is a service provider company and wouldn’t be ideal for companies looking for a full-fledged HRMS or a Payroll Solution.

Pros:

✔️ Strong Regional Presence – Focuses on payroll outsourcing across India and APAC.

✔️ Automation-Driven – Reduces manual payroll errors with automation.

Con:

❌ Limited HRMS Integration – Companies looking for a full HR suite may need additional software

5. Easy Source

Easy Source is an HR Solutions company that provides Payroll and Manpower Outsourcing, PEO, and other managed services. They have over 15 years of experience in HR solutions and have over 300 clients in their portfolio. They have an in-house team of 75 experts who provide 24/7 support for any resolution that you might need regarding your payroll.

However, it is important to know that Easy Source is a service and consulting firm, which means they do not offer any software solutions to their clients. Hence, it may not be suitable for organizations looking for a complete end-to-end HR and payroll software solution along with outsourcing services.

Pros:

✔️ 24/7 Support – Dedicated payroll experts provide round-the-clock assistance.

✔️ Comprehensive Compliance Handling – Takes care of tax filings and labor law compliance.

Con:

❌ No Proprietary Software – As a consulting firm, they do not offer integrated payroll software

6. Zing HR

ZingHR offers a range of HR, payroll, and HCM solutions for mid to large-sized enterprises. Some of their offerings include end-to-end HRMS solutions, workforce productivity solutions, and talent management solutions. They currently operate in India, Singapore, Australia, and a few other locations around the world. Enterprise-level companies can certainly benefit from their suite of products, but they may not be ideal for smaller companies only looking for simpler HRMS and payroll outsourcing.

Pros:

✔️ Cloud-Based & AI-Driven – Offers a modern and scalable payroll solution.

✔️ Integrated HRMS – Includes talent acquisition, employee engagement, and payroll processing.

Con:

❌ Expensive for Small Businesses – Comprehensive HR solutions may be overkill for startups

7. Osource

Osource has been a global player in the IT and business processing outsourcing space since 2004. The reason Osource is on this list is because of their HRO services, which include payroll management, employee lifecycle management, HR shared services, staffing, recruitment, risk and compliance management, and many other back-office processes.

Pros:

✔️ Comprehensive HR Outsourcing – Covers payroll, recruitment, and employee lifecycle management.

✔️ Strong Compliance Focus – Ensures regulatory compliance across multiple sectors.

Con:

❌ Not Ideal for SMEs – More suitable for mid-to-large enterprises due to service-based pricing

8. Paybooks

Paybooks offers payroll software and outsourcing services, serving over 3,000 businesses across India. The platform simplifies tax calculations and integrates with HRMS systems.

Pros:

✔️ Quick Implementation – Businesses can start processing payroll within days.

✔️ API-Driven Payroll System – Easily integrates with other HR tools.

Con:

❌ Limited Customization – Some advanced features may require third-party integrations

9. Hinduja Global Solutions

Hinduja Global Solutions (also known as HGS) is one of the major players in offering business process solutions and customer experience solutions across multiple sectors globally. The HGS Business Services Division offers various payroll services like end-to-end payroll outsourcing and compliance management; recruitment and structured staffing services as well as many other finance, accounting & HR services.

Pros:

✔️ Comprehensive Service Offering – Includes payroll, finance, and HR outsourcing.

✔️ Ideal for Large Enterprises – Suitable for companies with complex payroll needs.

Con:

❌ Not Focused on Payroll Alone – HGS offers broader BPO services, which may not be ideal for businesses seeking only payroll solutions

10. HRMThread

HRMThread by Sensys Technologies is an end-to-end HRMS and payroll outsourcing solution made for mid-sized businesses looking for a basic and affordable package to automate their HR processes. They offer both cloud-based and on-premise HR software and complete payroll with full n final settlement processing, along with compliance management for PF, ESIC, LWFM, etc.

Pros:

✔️ Affordable Pricing – Cost-effective for SMEs and startups.

✔️ Flexible Deployment – Available as both cloud-based and on-premise solutions.

Con:

❌ Basic Features – May not meet the complex payroll needs of large enterprises

Conclusion:

To conclude, there are many payroll outsourcing companies in India today that provide various forms of packages to their clients. However, before finalizing a vendor, you need to check whether your vendor can fulfill all your requirements and integrate with your current payroll software and HRMS. If you are on the hunt for the best payroll or HR Software then we would recommend you check our article on the Best payroll software for SMEs in India and the Best HRMS Software for SMEs in India.

FAQ’s

1. What is payroll outsourcing, and why do businesses need it?

Payroll outsourcing is the process of hiring a third-party provider to handle payroll processing, tax compliance, and salary disbursement. Businesses choose payroll outsourcing to save time, reduce errors, ensure compliance with labor laws, and improve efficiency.

2. How do I choose the right payroll outsourcing company for my business?

When selecting a payroll provider, consider factors such as industry experience, compliance expertise, automation capabilities, scalability, customer support, and pricing. The best payroll company depends on your business size and payroll complexity.

3. What are the key benefits of payroll outsourcing?

Outsourcing payroll helps businesses reduce costs, improve accuracy, ensure compliance with tax regulations, free up internal resources, and provide secure data management. It also allows access to advanced payroll software and analytics.

4. Are payroll outsourcing companies in India compliant with government regulations?

Yes, reputed payroll outsourcing firms like Quikchex ensure full compliance with Indian labor laws, tax regulations, and statutory requirements such as EPF, ESIC, PT, TDS, and GST.

5. What is the cost of outsourcing payroll services in India?

The cost of payroll outsourcing varies based on company size, number of employees, and the level of services required. Small businesses may pay as low as ₹500–₹1,500 per employee per month, while larger enterprises may have customized pricing plans.