How to check, transfer and withdraw your Provident Fund

As payroll and HR experts, majority of the questions we’re asked by our clients revolve around Provident Fund (PF) formalities. The compliance norms and best practices pertaining to PF have always been a concern for HR managers. However, what really matters to employees is how you can check your EPF balance and more importantly, how you can withdraw it.

How to check your PF balance?

Checking your PF balance has become much easier than it was previously. The EPFO has updated its records and has made PF balance digitally available. Here are 2 quick ways to check your EPF balance:

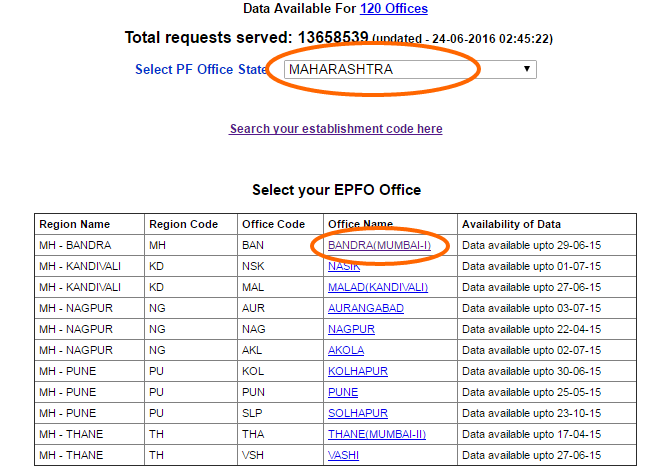

1) The online method: You can check your Provident Fund balance by simply logging on to the EPFO website. Here’s a step by step deduction of how to go about it:

a. Retrieve your PF account number. You can usually find this on your salary slip.

b. Visit the direct link: Member Passbook

c. Select the state in which your PF account is registered and then select the registered office for your PF account. In case you’re not sure of what your registered office is, you can find the details here: http://search.epfoservices.in/est_search.php

d. Fill in your PF number, Name and Mobile in the fields shown below and you’ll have your Total PF balance sent to you via SMS.

2) The Missed Call method: The preferred method of checking your PF balance is a simple missed call. Dial 011-2290-1406 and disconnect the call after a couple of rings. You’ll receive your PF balance via an SMS in a couple of minutes.

How to withdraw your Provident Fund Amount?

Coming to the crucial question of how do you actually withdraw your PF contribution. You can do this through your employer or without any intervention from your employer. There are a couple of forms that you will be required to fill along this process.

Now-a-day its mandatory PF can be withdrawn online through the Employee UAN account. The offline process of submitting the manual form is no more allowed. Still, in some special cases, it’s allowed.

1) Submitting your withdrawal claim through your employer

To submit your PF withdrawal claim through your employer you need submit the following forms:

a. Form 19

b. Form 10C

c. Form 15G

There are two types of forms. The (UAN) forms are meant to be filled when the employee wants to withdraw funds without the intervention of the employer. If you wish to withdraw your provident fund balance with your employers help, you don’t need to fill up the (UAN) forms.

You need the signature of an authorized signatory and the company stamp at the bottom of each page of the forms. Also make sure all the details you’ve filled up are accurate and they match the details that you’ve provided to your employer. Here are the documents you need to submit along with these forms (All documents are compulsory).

a) Employee’s PAN Card copy

b) Cancelled cheque (if your name isn’t printed on the cancelled cheque, attach a copy of bank statement or passbook first page as well)

c) Member UAN Number is compulsory, and without this PF form won’t be accepted by PF department. (Click here to know how to generate your UAN number)

Once you’ve completed the forms and attached your required documents, submit these to your past employer. Once, you’ve done that, the employer will submit it to the registered PF office and complete the formalities for your PF withdrawal claim.

2) Submitting your PF claim without your employer

The EPFO online withdrawal claim process is very comfortable and less time-consuming.

Before filling out these forms ensure that the following requisites are completed:

a) You must have your UAN number

b) Your UAN account should be activated.

c) The UAN database should have your bank account number, PAN card and Aadhaar number

d) All of the above KYC documents should be approved digitally by your employer.

e) You must register your mobile number with UAN account which is added with your Aadhaar number.

f) All the personal information available at UAN portal should be correct.

g)Attach a cancelled cheque along with these forms. Form 15G declaration to be available.

How to transfer your Provident Fund balance

As an employee, if you are going to switch your job you have two options to take into account i.e. either withdraw your PF amount or transfer the account or balance to your new employer. You should not withdraw your PF corpus while you are already employed and want to continue doing so. PF is a government-backed scheme that is a long-term investment vehicle in nature. As a result, it is recommended that you only withdraw your PF in an emergency. Instead of withdrawing your EPF amount, you can transfer it to your new employer. This happens automatically by providing your UAN account number with your current employer.