Automate Your Payroll: Discover the Benefits of Payroll Management System

In today’s digital age, the role of human resources (HR) has evolved far beyond hiring and training. HR departments now handle everything from managing benefits to ensuring compliance with labor laws. But perhaps the most intricate task they face is payroll management. Without proper tools, payroll can become an administrative nightmare. Enter HR payroll software—a solution that automates and simplifies payroll processes, ensuring businesses can focus on growth instead of grappling with paperwork.

What is HR Payroll Software?

HR payroll software is an automated system designed to manage the full payroll lifecycle. From tracking hours worked to calculating wages and distributing payments, this software ensures that payroll operations are streamlined. Most modern payroll software integrates with broader HR management systems (HRMS), meaning payroll and employee data are centrally stored and easily accessible.

These solutions are especially valuable for businesses handling multiple employees, tax jurisdictions, and benefits. By automating these tasks, HR payroll software minimizes manual input and reduces the risk of errors, making payroll processes more reliable and efficient.

Key Features of HR Payroll Software

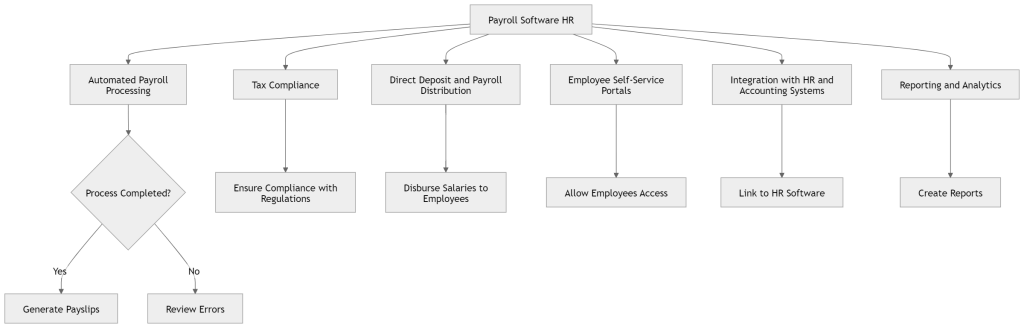

1. Automated Payroll Processing

One of the most critical features of any payroll software is its ability to automate processes. Calculating wages, deducting taxes, and filing required forms is tedious and time-consuming when done manually. Automated payroll systems process payroll seamlessly, minimizing human error and ensuring that employees are paid accurately and on time.

2. Tax Compliance

Tax laws change frequently, and staying compliant is one of the biggest challenges for any business. Payroll software is designed to automatically update tax tables and file taxes on time, preventing costly mistakes. Whether your company operates locally or in multiple states or countries, HR payroll software can adapt to various tax regulations.

3. Direct Deposit and Payroll Distribution

Gone are the days when employees had to wait for paper checks. Payroll software supports direct deposits, allowing companies to deposit wages directly into employees’ bank accounts. This not only ensures timely payment but also enhances employee satisfaction by eliminating the inconvenience of lost or delayed checks.

4. Employee Self-Service Portals

Most payroll software today offers an Employee Self-Service (ESS) portal. Through this portal, employees can access their pay stubs, tax forms, and benefits information at any time. This not only empowers employees but also reduces the burden on HR staff, allowing them to focus on other strategic tasks.

5. Integration with HR and Accounting Systems

HR payroll software should not operate in isolation. Seamless integration with existing HR and accounting systems is crucial. This ensures that employee data, financial records, and other key information flow easily between departments, reducing the need for duplicate entries and manual reconciliation.

6. Reporting and Analytics

A robust payroll system should come with advanced reporting features. From payroll summaries to detailed analytics on overtime costs or tax deductions, these reports give HR and finance teams deeper insights into payroll trends. This helps businesses plan budgets, track employee costs, and ensure compliance during audits.

HR Payroll Software Benefits

1. Time and Cost Savings

Manual payroll management is time-intensive and prone to errors. Automating this process significantly reduces administrative workloads, freeing up HR teams to focus on more value-adding activities. Over time, this leads to significant cost savings as companies reduce the need for manual intervention and rework due to payroll errors.

2. Accuracy and Reduced Errors

HR payroll software eliminates the risk of human error in payroll calculations. Mistakes in wages or tax deductions can lead to disgruntled employees and potential fines. With payroll software, these errors are minimized, ensuring employees are paid correctly and tax obligations are met on time.

3. Enhanced Data Security

Sensitive payroll data, including employees’ personal details and salary information, must be protected. Payroll software offers high-end encryption, role-based access control, and secure data storage to safeguard this information, reducing the risk of unauthorized access or data breaches.

4. Improved Employee Satisfaction

Payroll accuracy is essential for maintaining trust between employers and employees. Late or incorrect payments can cause frustration and reduce morale. By ensuring that employees are paid accurately and on time, HR payroll software helps to maintain employee satisfaction.

5. Scalability

As businesses grow, so does their workforce, and managing payroll for a growing team becomes increasingly complex. HR payroll software is scalable, meaning it can handle more employees, additional tax jurisdictions, and more sophisticated payroll structures without needing a complete overhaul.

Advanced Features of Payroll Software

1. Employee Self-Service

In addition to basic payroll features, many software solutions now offer advanced Employee Self-Service (ESS) portals. Employees can view their own payroll information, including tax forms and pay slips, at their convenience. This not only empowers employees but also minimizes the need for HR involvement in routine queries.

2. Cloud-Based Payroll

Cloud-based payroll software enables HR teams to access payroll data from anywhere with an internet connection. This is especially important in today’s world, where remote work has become more prevalent. Cloud payroll solutions ensure that businesses can manage payroll in real time and offer greater flexibility and scalability compared to traditional on-premise systems.

3. Time and Attendance Tracking

Time-tracking is a vital aspect of payroll management. Payroll software that integrates time and attendance data ensures employees are paid accurately for the hours they work. Whether through punch-in systems, biometric scanners, or mobile apps, this integration guarantees fair wages and eliminates the need for manual time calculations.

4. Real-Time Compliance Updates

Payroll laws and tax regulations change frequently, and staying compliant can be daunting. The best payroll software solutions automatically update their tax tables to ensure compliance with the latest laws, reducing the risk of penalties and fines for businesses.

Choosing the Right HR Payroll Software

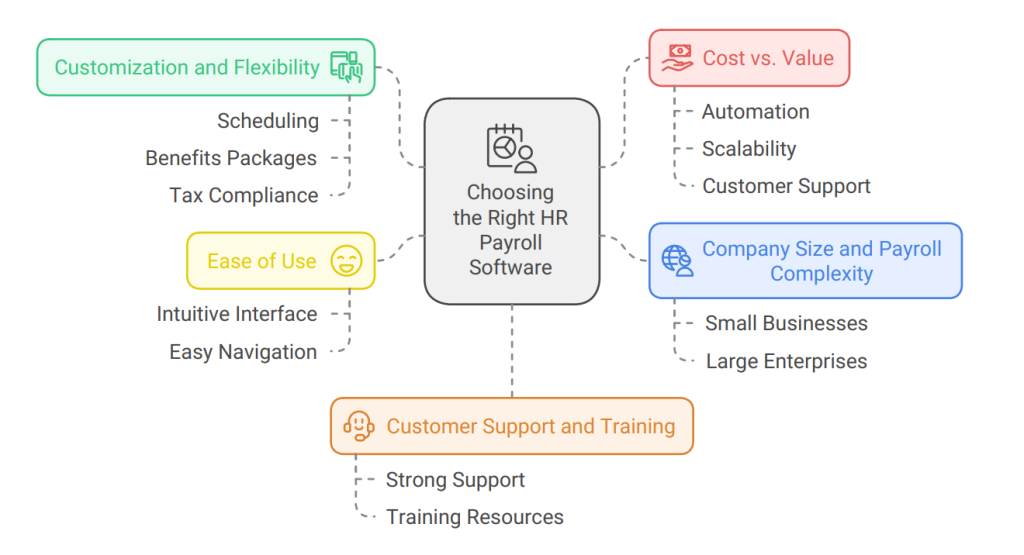

1. Assessing Company Size and Payroll Complexity

Different businesses have different payroll needs. Small businesses might only need simple payroll software to calculate salaries and taxes, while large enterprises with complex payroll structures might require more advanced features like multi-jurisdiction tax management or comprehensive reporting tools.

2. Customization and Flexibility

No two businesses are the same, and your payroll software should reflect that. Look for a solution that offers customization—whether it’s for scheduling, benefits packages, or tax compliance. The ability to tailor the software to fit your unique business needs ensures a smoother integration with your existing processes.

3. Ease of Use

One of the most overlooked factors when selecting payroll software is ease of use. Complicated systems can lead to frustration and wasted time. Choose software with an intuitive interface that’s easy to navigate, ensuring your HR team can focus on more critical tasks without a steep learning curve.

4. Customer Support and Training

Implementing new software can be challenging, especially for businesses transitioning from manual processes. It’s essential to choose a vendor that provides strong customer support and training resources to help ensure a smooth rollout and ongoing success.

5. Cost vs. Value

While cost is a key consideration, businesses should focus on value. The cheapest option may not always offer the best features or support. Instead, weigh the cost against the benefits—such as automation, scalability, and customer support—to ensure you’re investing in a solution that will provide long-term value.

Introducing Quikchex: The Leading HR Payroll Software

When it comes to managing HR and payroll processes, one name stands out in the industry—Quikchex. As a comprehensive HR payroll software, Quikchex offers a range of features designed to simplify payroll management, tax compliance, and employee self-service for businesses of all sizes. Quikchex is tailored for Indian businesses, making it an ideal choice for organizations operating in a complex regulatory environment.

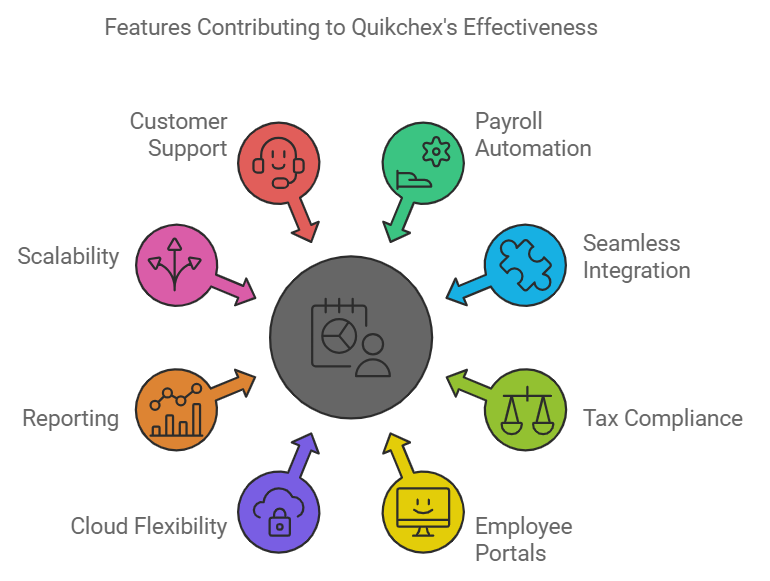

Why Quikchex is the Best HR Payroll Software

1. Comprehensive Payroll Solutions

Quikchex automates payroll processing, from calculating wages and deductions to managing benefits and tax filings. It ensures employees are paid accurately and on time while staying compliant with the latest tax regulations. This automation minimizes manual intervention, saving time and reducing the risk of costly errors.

2. Seamless Integration

Quikchex integrates seamlessly with existing HR management and accounting systems. This ensures that employee data flows smoothly across departments, eliminating the need for repetitive data entry and reducing the chance of errors.

3. Compliance with Indian Tax Laws

One of Quikchex’s strongest features is its ability to keep businesses compliant with India’s complex tax regulations. The software automatically updates to reflect changes in tax laws, ensuring that your payroll processes always follow the latest rules. This helps businesses avoid penalties and ensures employees’ tax deductions are accurate.

4. Employee Self-Service Portals

Quikchex provides employees with access to an easy-to-use self-service portal where they can view pay slips, tax information, and leave balances. This enhances employee satisfaction and reduces the administrative burden on HR teams by eliminating the need for employees to request payroll data manually.

5. Cloud-Based Flexibility

With Quikchex’s cloud-based platform, businesses can access payroll data from anywhere, anytime. This feature is especially valuable in today’s work environment, where remote work has become more prevalent. The cloud system ensures real-time updates, data security, and scalability without requiring costly infrastructure investments.

6. Detailed Reporting and Analytics

Quikchex goes beyond simple payroll management by offering comprehensive reporting and analytics features. Businesses can generate detailed reports on employee costs, tax deductions, and overtime expenses, helping them make informed financial decisions and plan for the future.

7. Scalability for Growing Businesses

As businesses expand, so do their HR and payroll needs. Quikchex is designed to scale with your business, allowing you to add more employees, integrate additional tax regulations, and handle complex payroll structures with ease. It’s a solution that grows with you, ensuring long-term usability.

8. Exceptional Customer Support

Quikchex provides top-notch customer support, offering assistance throughout the implementation process and beyond. Whether it’s troubleshooting or helping businesses maximize the software’s potential, the Quikchex team is known for its responsiveness and expertise.

Conclusion: Quikchex—The Smart Choice for Payroll Management

Quikchex stands out as the best HR payroll software for businesses looking to streamline payroll operations while staying compliant with local tax regulations. Its comprehensive features, seamless integration, and focus on security and scalability make it an indispensable tool for organizations of any size. By choosing Quikchex, companies can ensure accuracy, efficiency, and employee satisfaction, making it a smart investment for long-term success.

FAQs

1. What is the difference between HR software and payroll software?

HR software handles various functions like recruitment, performance management, and employee data management, whereas payroll software focuses solely on managing employee compensation, taxes, and payroll compliance.

2. Can small businesses benefit from payroll software?

Absolutely. Even small businesses can save time, reduce errors, and stay compliant with tax laws by automating their payroll processes with software.

3. How does payroll software ensure compliance with tax laws?

Payroll software is updated automatically with the latest tax regulations, ensuring accurate tax calculations and timely filings to prevent compliance issues.

4. Are cloud-based payroll systems secure?

Yes, cloud-based payroll systems use advanced encryption methods and secure access controls to protect sensitive data, ensuring that employee information remains confidential.

5. What key factors should be considered when choosing payroll software?

Consider factors such as company size, payroll complexity, ease of use, scalability, customer support, and the software’s ability to integrate with existing HR and accounting systems.

6. Is Quikchex suitable for businesses of all sizes?

Yes, Quikchex is designed to scale with your business, making it suitable for startups, small businesses, and large enterprises alike. Its flexible features cater to businesses with simple or complex payroll needs.

7. Can Quikchex handle payroll for multiple locations and jurisdictions?

Absolutely. Quikchex is equipped to manage payroll across multiple locations and jurisdictions, ensuring compliance with regional tax laws and regulations.

8. Does Quikchex support benefits and expense management?

Yes, Quikchex includes features for managing employee benefits such as health insurance and retirement plans, as well as reimbursing expenses. This streamlines the process for both HR teams and employees.

9. What kind of security does Quikchex offer for sensitive payroll data?

Quikchex provides advanced security features, including data encryption, secure cloud storage, and role-based access controls to ensure that sensitive payroll and employee data is protected from unauthorized access.

10. How quickly can Quikchex be implemented in my business?

Quikchex offers a streamlined onboarding process, allowing businesses to set up and integrate the software quickly. The exact time depends on the size and complexity of the business, but Quikchex offers support throughout the implementation phase to ensure a smooth transition.