Navigating Payroll Management Software: 14 Errors That Could Cost You

Choosing payroll management software is a crucial decision for any organization, as it directly impacts employee satisfaction, compliance with regulations, and operational efficiency. While it’s important to focus on the key features payroll software offers, it’s equally important to be aware of potential pitfalls and factors to avoid. The wrong choice can result in inefficiencies, compliance risks, and increased costs in the long run.

In this comprehensive guide, we will explore 14 mistakes to avoid while choosing payroll management software to help ensure that you select a solution that is scalable, reliable, and effective for your organization’s needs.

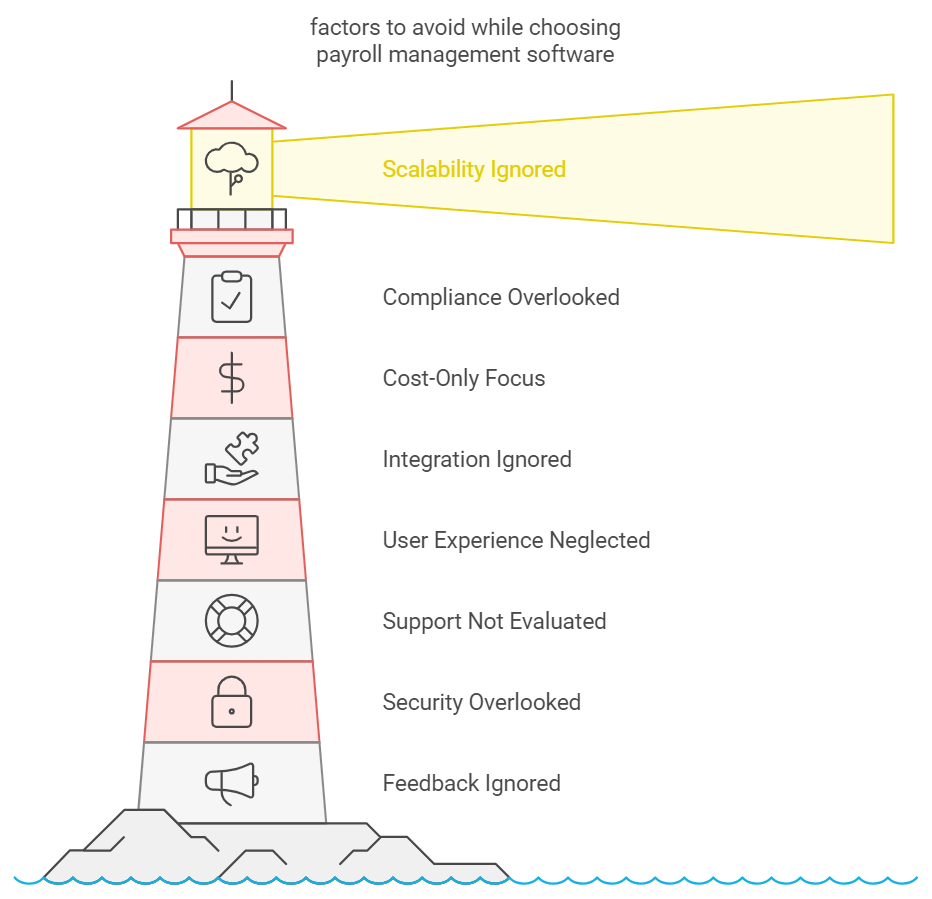

The 14 Mistakes To Avoid While Choosing Payroll Management Software

1. Ignoring Scalability

One of the most significant mistakes organizations make when selecting payroll software is failing to consider future growth. A solution that works perfectly for a small or midsized company may not be able to handle the needs of a larger, more complex organization. It is essential to avoid software that doesn’t offer the flexibility to scale up as your business grows.

Why it’s a problem: If the software can’t handle increased employee counts, new pay structures, or additional locations, you’ll eventually need to switch systems, leading to costly transitions.

Solution: Choose payroll software that can scale in terms of users, features, and integrations as your organization grows.

2. Overlooking Compliance Features

Payroll management is not just about calculating salaries; it’s also about adhering to local, state, and federal regulations. Overlooking the importance of compliance can lead to severe legal and financial consequences for your business. Non-compliance with tax laws, labor laws, or benefits regulations can result in fines and reputational damage.

Why it’s a problem: Laws change frequently, and non-compliance could lead to penalties or audits.

Solution: Ensure the software automatically updates to reflect new labor laws and tax codes and has the flexibility to manage the complexities of multi-state or international payroll compliance.

3. Choosing Based Solely on Cost

Many organizations are tempted to select payroll software based solely on the upfront costs. However, a cheap system might lack crucial features, provide poor customer support, or require additional fees for necessary add-ons. A low-cost solution may end up being expensive in the long run due to hidden fees or productivity losses.

Why it’s a problem: Less expensive software could lack essential features like tax compliance, reporting, or employee self-service.

Solution: Focus on the total value the software brings rather than just the price. Consider the long-term ROI (Return on Investment) by weighing the cost against the time saved, employee satisfaction, and compliance assurance.

4. Ignoring Integration Capabilities

In today’s business environment, software interoperability is key to ensuring smooth and efficient operations. Many companies overlook integration capabilities when selecting payroll software, assuming it will function as a standalone system. However, payroll systems often need to integrate with accounting software, HR management systems, time tracking tools, and benefits management platforms.

Why it’s a problem: Without proper integration, manual data entry is required, increasing the risk of errors and consuming valuable time.

Solution: Choose a payroll solution that can easily integrate with other core business software to streamline operations and reduce data redundancy.

5. Neglecting User Experience

User experience (UX) is crucial for ensuring that both employees and administrators can efficiently use the payroll software. If the software has a complicated interface or is difficult to navigate, it can lead to errors and reduce productivity.

Why it’s a problem: A complex system could lead to frustration, longer learning curves, and mistakes in payroll processing.

Solution: Prioritize software that is user-friendly and intuitive for both payroll administrators and employees. A good payroll system should include an easy-to-navigate dashboard, clear instructions, and responsive customer support.

6. Not Evaluating Customer Support

Customer support is a critical factor that many organizations overlook during the selection process. In the event of a technical issue, you’ll want to resolve problems quickly to avoid delays in payroll processing, which could lead to employee dissatisfaction or compliance issues.

Why it’s a problem: Poor customer support can result in prolonged downtime, errors, or unresolved issues that can delay payroll processing.

Solution: Test the quality of customer support during the trial period and read reviews from other users. Ensure the vendor offers multiple support channels like phone, chat, and email, along with timely responses.

7. Overlooking Security Features

Payroll systems store sensitive data such as personal employee information, salaries, and tax identification numbers. Inadequate security measures can lead to data breaches, which can result in identity theft, financial loss, and legal repercussions.

Why it’s a problem: Payroll data is a prime target for hackers, and any breach could result in severe financial and reputational damage.

Solution: Ensure that the payroll management software employs strong encryption protocols, offers multi-factor authentication, and complies with relevant data protection regulations like GDPR or CCPA.

8. Failure to Consider Mobile Accessibility

With remote work becoming increasingly common, payroll administrators may need to access payroll systems from different locations. Some organizations fail to consider mobile accessibility when choosing a payroll solution, limiting flexibility for administrators and employees.

Why it’s a problem: Lack of mobile access can hinder payroll processing, especially in urgent situations where administrators or employees can’t access the system from a traditional desktop.

Solution: Choose software that has mobile compatibility or a dedicated mobile app to allow for on-the-go payroll management and employee self-service.

9. Not Testing Before Purchasing

Some organizations skip the testing phase and purchase payroll software without a proper trial period. This can lead to unforeseen issues with the software’s usability, features, or integration capabilities once it’s fully deployed.

Why it’s a problem: You might find that the software doesn’t meet your unique needs after purchase, leading to wasted time and money.

Solution: Always request a demo or free trial period before making a final decision. This will allow you to evaluate the software’s performance in real-world scenarios and ensure it fits your requirements.

10. Lack of Customization Options

Not all organizations have the same payroll requirements. If you choose software that lacks customization options, you might struggle to configure it to suit your specific needs, such as customized payroll reports, unique employee benefits, or special pay schedules.

Why it’s a problem: A rigid system that cannot be tailored to your needs may cause inefficiencies and limit your ability to manage payroll effectively.

Solution: Opt for payroll software that allows customization of key features, such as pay periods, deductions, and reporting formats, to better align with your company’s needs.

11. Ignoring Cloud-Based Solutions

Some organizations still opt for traditional, on-premises payroll software rather than cloud-based solutions. However, cloud-based systems offer a number of advantages, including automatic updates, remote access, and reduced infrastructure costs.

Why it’s a problem: On-premises software often requires more IT support and lacks the flexibility that cloud-based solutions offer, particularly when it comes to updates and remote access.

Solution: Consider a cloud-based payroll solution that allows for real-time updates, anywhere access, and reduced need for IT infrastructure management.

12. Not Considering Employee Self-Service

Employee self-service (ESS) functionality allows employees to access their own payroll information, update their details, and download pay stubs or tax forms. Overlooking this feature can burden HR and payroll departments with additional administrative tasks.

Why it’s a problem: Without self-service, employees will rely on HR to manually provide them with essential payroll documents, leading to inefficiencies and delays.

Solution: Choose payroll software that includes an employee self-service portal to reduce administrative workload and empower employees to manage their own payroll data.

13. Focusing on Too Many Unnecessary Features

While having feature-rich payroll software can be an advantage, some organizations make the mistake of focusing too much on unnecessary features that complicate the system. This can make the software harder to use and more expensive without adding any real value.

Why it’s a problem: Extra, unused features can clutter the interface and make the software more difficult to navigate, leading to a steeper learning curve and a more complicated payroll process.

Solution: Prioritize the features that are critical for your organization and avoid software that includes unnecessary bells and whistles that don’t align with your needs.

14. Ignoring Feedback from Current Users

Often, the decision to choose payroll software is made by a small team or individual without consulting those who will actually use it, such as HR professionals, payroll managers, or even employees.

Why it’s a problem: The software might not align with the actual needs and preferences of the end-users, resulting in poor adoption and increased errors.

Solution: Gather feedback from key stakeholders, including HR personnel and payroll administrators, before making a final decision. Their input can provide valuable insights into usability and necessary features.

Conclusion

When selecting payroll management software, it’s not just about what the system offers but also about avoiding common pitfalls that could affect the software’s efficiency and your organization’s compliance, scalability, and overall operational success. Keep in mind the long-term growth of your company, the importance of user experience, the necessity of integration with other systems, and security. By carefully evaluating these factors, you can avoid costly mistakes and choose a payroll management solution that meets both your current and future needs.

FAQ’s

1. What is payroll management software?

Payroll management software automates the process of managing employee payments, tax deductions, benefits, and compliance with labor laws. It handles tasks such as calculating wages, generating pay stubs, processing direct deposits, and ensuring compliance with tax regulations.

2. Why is it important to choose the right payroll management software?

The right payroll software ensures timely and accurate payments to employees, compliance with tax and labor laws, data security, and efficient HR operations. A poor choice can lead to errors, non-compliance penalties, and wasted resources.

3. What features should I look for in payroll management software?

Look for key features such as:

1. Automated payroll processing

2. Tax calculation and compliance updates

3. Employee self-service portal

4. Integration with accounting and HR systems

5. Customizable reports

6. Mobile access

7. Multi-currency and multi-language support if operating globally

4. How does payroll software ensure compliance with local labor laws and tax regulations?

Good payroll software is regularly updated to reflect changes in tax codes, labor laws, and regulations. This helps ensure compliance by automating calculations for taxes, overtime, and other legal requirements.

5. Can payroll software integrate with other business systems?

Yes, modern payroll software can integrate with HR management systems, accounting software, time and attendance tools, and other business applications. This allows for seamless data flow and reduces manual data entry errors.

6. What are the advantages of cloud-based payroll software?

1. Cloud-based payroll software offers:

2. Accessibility from anywhere

3. Automatic updates for compliance and new features

4. Lower upfront infrastructure costs

5. Easier scalability for growing businesses

7. Is data security a concern with payroll management software?

Yes, data security is crucial since payroll systems contain sensitive employee information such as social security numbers, tax details, and bank account information. Look for software with strong encryption, multi-factor authentication, and compliance with data protection regulations.

8. What is the difference between on-premises and cloud-based payroll software?

On-premises software is installed locally on your company’s servers, offering control but requiring IT support and infrastructure.

Cloud-based software is hosted on remote servers and accessed via the internet, providing flexibility, automatic updates, and reduced IT overhead.

9. How can I ensure the payroll software is user-friendly?

Test the software through a demo or free trial to see how intuitive the interface is. Gather feedback from your payroll administrators, HR staff, and employees to ensure it meets their needs.

10. Can payroll software handle multi-country payroll?

Some payroll software solutions are designed to manage multi-country payroll, including different tax regulations, currencies, and languages. If your organization operates in multiple countries, ensure the software supports global payroll capabilities.