Mastering Expense Management Software for Modern Businesses

Expense management is the strategic process of organizing, tracking, and controlling a company’s expenditure. While commonly viewed as simply approving expenses and reimbursing employees, effective expense management is much broader—it includes enforcing policies, auditing, and leveraging technology to streamline processes and improve financial control.

In today’s corporate landscape, efficient expense management is integral for companies to maintain financial health and achieve operational goals.

In this comprehensive guide, we’ll delve into the core types of expenses, various expense management methods, the advantages of automating these processes, and best practices for streamlined expense management.

Introduction to Expense Management

In today’s fast-paced business environment, expense management is essential for maintaining control over spending and optimizing budgets. Effective expense management entails far more than approving employee reimbursements; it incorporates defining clear policies, controlling costs, detecting fraud, and improving cash flow visibility. By creating an efficient expense management strategy, companies can enhance employee satisfaction, increase compliance, and foster sustainable growth.

Types of Business Expenses

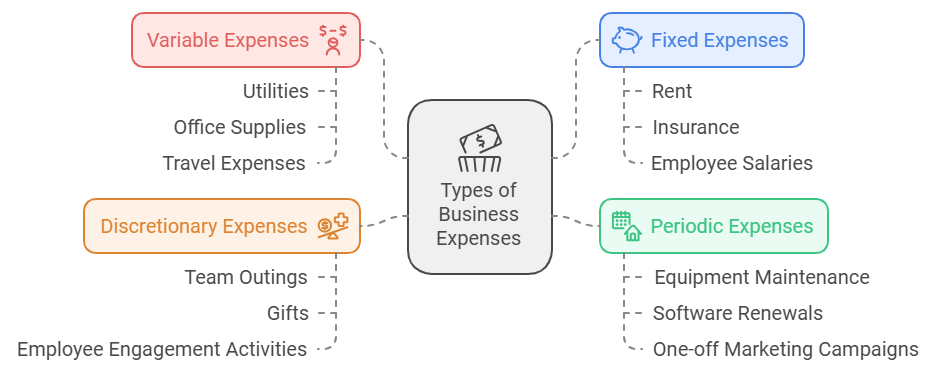

A foundational part of expense management is categorizing expenses to establish clear guidelines. Here are four main types of business expenses:

1. Variable Expenses: Costs that fluctuate based on usage, such as utilities, office supplies, or travel expenses. Managing variable expenses can be challenging, as these costs can rise unexpectedly and affect budget forecasts.

2. Fixed Expenses: These are consistent, recurring costs like rent, insurance, and employee salaries. Fixed expenses provide predictability and stability in budgeting but need to be monitored to avoid wasteful spending.

3. Periodic Expenses: These expenses occur at intervals, such as equipment maintenance, software renewals, or one-off marketing campaigns. Companies must anticipate and allocate funds for periodic expenses to avoid budget shortages.

4. Discretionary Expenses: Often viewed as non-essential, discretionary expenses include perks like team outings, gifts, or employee engagement activities. While these expenses are usually flexible, they can be instrumental in boosting team morale and culture.

Understanding each category aids in crafting policies that employees can easily follow, which, in turn, streamlines the reimbursement and approval process.

Methods of Expense Management

The approach to managing expenses varies greatly depending on company size, budget, and goals. Here are the three primary methods:

1. Paper Forms: The most traditional method, paper forms involve manually tracking and approving expense reports. This approach is low-cost but time-consuming and prone to human error, making it best suited for small businesses with few transactions.

2. Spreadsheets: Widely used by medium-sized companies, spreadsheets offer more flexibility and are cost-effective. However, spreadsheets require manual data entry, which is inefficient and difficult to scale as companies grow.

3. Expense Management Software: Digital solutions offer an automated approach, handling everything from expense capture to real-time reporting. Ideal for larger organizations, expense management software improves efficiency, compliance, and accuracy, enabling better financial planning and analysis.

Significance of Effective Expense Management

An effective expense management process brings extensive benefits, including:

For Employees: Faster approvals and reimbursements lead to higher satisfaction and productivity, as employees don’t have to wait long to recover their expenses.

For Finance Teams: Automation reduces the workload by minimizing manual tasks and errors. Finance teams can focus on strategic tasks, such as financial analysis and budget forecasting.

For CFOs: Real-time data and analytics empower CFOs to make better-informed decisions, optimize cash flow, and ensure compliance with company policies and regulations.

The Traditional Expense Management Process

A typical manual expense management process involves several steps:

1. Submission: Employees submit expense reports and attach physical receipts.

2. Approval: Managers review expenses for policy compliance and approve or reject claims.

3. Auditing: Finance conducts audits to detect errors, policy breaches, or fraudulent claims.

4. Reimbursement: Approved expenses are reimbursed to employees, and finance stores records for future audits.

Challenges in this process include high error rates, delayed reimbursements, increased chances of fraud, and a lack of real-time insights.

Automated Expense Management Process

Automated expense management software simplifies and streamlines each stage of the process. In an automated system:

1. Expense Capture: Employees can snap photos of receipts, which the software processes using OCR to extract data automatically.

2. Automated Policy Compliance: Expenses are checked against policy rules, flagging non-compliant claims.

3. Streamlined Approval Process: Automated routing sends expense reports to relevant approvers, reducing the time to reimburse.

4. Real-Time Data Access: Finance and management teams gain instant insights into expense trends, enabling better budget management.

Automation saves time, reduces error rates, and provides a seamless experience for both employees and finance teams.

Comparing Traditional vs. Automated Expense Management

The differences between manual and automated expense management include:

Accuracy: Automation reduces data entry errors by using OCR and other technologies to capture receipt information accurately.

Fraud Prevention: Automated systems can quickly detect duplicate submissions or policy violations.

Compliance: Automated systems consistently enforce T&E policies, eliminating subjective decisions and enhancing compliance.

Approval Speed: Manual approvals can take days or weeks, while automated systems process requests instantly, reducing waiting times.

Real-Time Data Access: Automated systems provide live insights, while manual methods can delay data access until reports are manually processed.

Common Challenges in Expense Management

Expense management presents several challenges for companies, including:

Unclear Policies: Without well-defined policies, employees may submit inappropriate expenses, leading to confusion and frustration.

Poor Expense Visibility: Inadequate insights into spending patterns hinder budgeting and financial forecasting.

Inefficiencies: Manual processes slow down expense reporting, approval, and reimbursement, affecting employee satisfaction.

Delayed Reimbursements: Slow processing times can impact employee morale, particularly if they incur significant out-of-pocket expenses.

Best Practices for Effective Expense Management

To enhance expense management, companies should adopt these best practices:

Clear policies: define reimburseable expenses and outline documentation requirements to prevent errors and disputes.

Automation: Leverage expense management software to automate submission, compliance checks, and approvals.

Audits: Conduct automated audits to identify errors and fraud, maintaining financial integrity.

Corporate Credit Cards: Issue corporate cards for business expenses to simplify tracking and reconciliation.

Understanding Expense Management Software

Expense management software offers a digital solution for tracking, processing, and controlling employee expenses. Typical features include:

Expense Capture: Employees can upload receipts via mobile apps or email integrations, reducing paperwork.

Policy Enforcement: Automated compliance checks ensure expenses meet company standards.

Approval Workflow: Customizable workflows allow companies to adapt approval processes to organizational needs.

Real-Time Reporting: Provides instant insights into expense trends, aiding in budgeting and financial planning.

Benefits of Automated Expense Management Software

Automated expense management offers multiple advantages over manual methods:

Efficient Reporting: Simplifies submission and processing, saving time for employees and finance teams.

Enhanced Accuracy: OCR technology reduces data entry errors, ensuring accurate records

Fraud detection: policy compliance checks minimize the chance of duplicate submissions or non-compliant claims.

Real-Time Data: Instant access to spending data enables better financial decision-making.

Scalability: Automated solutions grow with the company, providing flexibility to accommodate increased transactions.

Key Features to Look for in an Expense Management System

Selecting the right expense management software is essential for a successful implementation. Key features include:

1. Mobile Accessibility: Employees should be able to submit reports on the go.

2. Customizable Approval Workflows: Tailored workflows ensure faster processing and approvals.

3. Policy Automation: Automated compliance checks reduce time spent on manual reviews.

4. Corporate Credit Card Reconciliation: Simplifies reconciliation for corporate card users, saving time and reducing errors.

5. Data Analytics: In-depth reporting offers insights for improved financial control and budgeting.

6. System Integration: seamless integration with existing ERP, HR, and payroll systems ensures efficient data sharing.

Best Practices for Implementing Expense Management Software

Implementing expense management software requires careful planning. Key best practices include:

Training and Onboarding: Provide training to ensure employees understand how to use the system effectively.

Customizable Policies: Adjust the software’s settings to align with company-specific policies and workflows.

Regular Audits: Automate regular audits to detect compliance issues or fraud.

Continuous Improvement: Monitor usage and gather feedback to make necessary adjustments and optimize the system.

Conclusion

Expense management is a critical function for any organization, enabling better budget control, enhancing compliance, and optimizing cash flow. Companies should evaluate their expense management process and consider automating it with specialized software to reduce errors, prevent fraud, and increase efficiency. By adopting a streamlined, policy-compliant approach, businesses can improve financial transparency, ensure employee satisfaction, and strengthen their operational resilience.

FAQs

1. What does expense management software do?

It automates the expense tracking, approval, and reimbursement process, making it easier to manage expenses and enforce policy compliance.

2. How does automation help prevent fraud?

Automated systems detect duplicate claims, policy violations, and unusual spending patterns, minimizing opportunities for fraudulent claims.

3. Why is policy compliance important in expense management?

Policy compliance ensures expenses align with company guidelines, preventing overspending and helping maintain financial discipline.

4. Can small businesses benefit from expense management software?

Absolutely. Automated expense management saves time, reduces manual work, and improves financial tracking, which is beneficial for businesses of any size.

5. How does real-time data improve expense management?

Real-time insights enable proactive financial decision-making, allowing companies to adjust budgets and manage resources more effectively.

6. Is expense management software easy to integrate with other systems?

Many solutions, like Quikchex, offer integrations with ERP, HR, and accounting software, making data sharing and financial tracking seamless.