Tag Archives: PMS

Best Performance Management System in India

Introduction

A performance evaluation period is one of the most critical phase of any organization, both for employers as well as employees. Organizations that do not have a streamlined process or system to evaluate the performance of their employees based on appropriate parameters and goals may fail to provide a fair and consistent evaluation. A Performance Management System helps in this process by systematically analysing and tracking various components of an employee’s performance based on PMS policies set up by the HR team. A good PMS system can directly enhance the motivation and productivity of your employees. Let’s take a look at how a PMS can benefit your organization before diving into the Best Performance Management System in India.

What is PMS?

Performance Management System or PMS is a process used by organizations to continuously monitor and improve the performance of their employees. It involves setting clear expectations, providing feedback, identifying areas for improvement, and supporting employee development.

A well-designed PMS can help organizations align employee goals with business objectives, increase productivity, and enhance overall organizational effectiveness. In this article, we will explore various factors on components of a performance management system and discuss best practices for implementing an effective PMS that drives employee engagement and performance.

Benefits of PMS

-

Goal alignment:

A good PMS can assist you in aligning employee goals with the overall business objectives of the organization. This ensures that all employees are working towards the same goals, increasing productivity and efficiency.

-

Increased productivity:

A PMS can improve employee performance by providing regular feedback, coaching, and recognition. This leads to increased motivation and productivity, as employees are more engaged and invested in their work.

-

Improved communication:

A PMS provides a platform for regular communication between managers and employees. This improves transparency, builds trust, and ensures that everyone is working towards the same goals.

-

Employee development:

A PMS can identify areas where employees need additional training and development. This helps employees to grow and develop in their roles, leading to increased job satisfaction and retention.

-

Data-driven decisions:

A PMS provides managers with data and insights into employee performance. This helps managers make informed decisions about promotions, compensation, and other HR-related issues. Additionally, the data can be used to identify trends and areas for improvement within the organization.

Factors to take into account before buying PMS

Before opting for a performance management system, there are several factors that organizations should consider to ensure that they select the right system to meet their needs. Here are five key factors to consider:

-

Business goals:

The PMS should align with the organization’s overall business goals and objectives. This includes identifying the key performance indicators (KPIs) that are most important to the organization and ensuring that the PMS can track and measure these KPIs.

-

Company culture:

The PMS should fit with the organization’s culture and values. It should be designed in a way that is consistent with the organization’s approach to management and employee development.

-

Employee engagement:

The PMS should be designed to engage employees and promote a culture of continuous improvement. It should provide employees with opportunities to receive feedback and be involved in the goal-setting process.

-

Scalability

The PMS should be able to scale as the organization grows. It should be flexible enough to accommodate changes in the organization’s structure, processes, and workforce.

-

Ease of use:

The PMS should be user-friendly and easy to use. It should not require extensive training or technical expertise to operate. Additionally, it should integrate well with other HR systems and tools already in use within the organization.

Now that we know the checklist of the things to look out for before implementing a new PMS. Let’s take a look at the top 10 best Performance Management System in India.

Top 10 best Performance Management System in India.

-

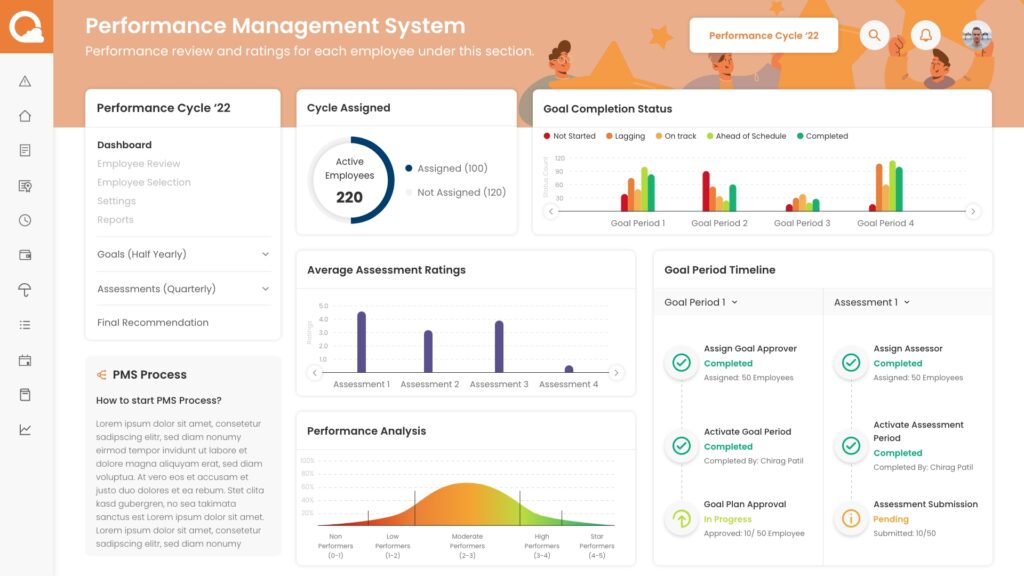

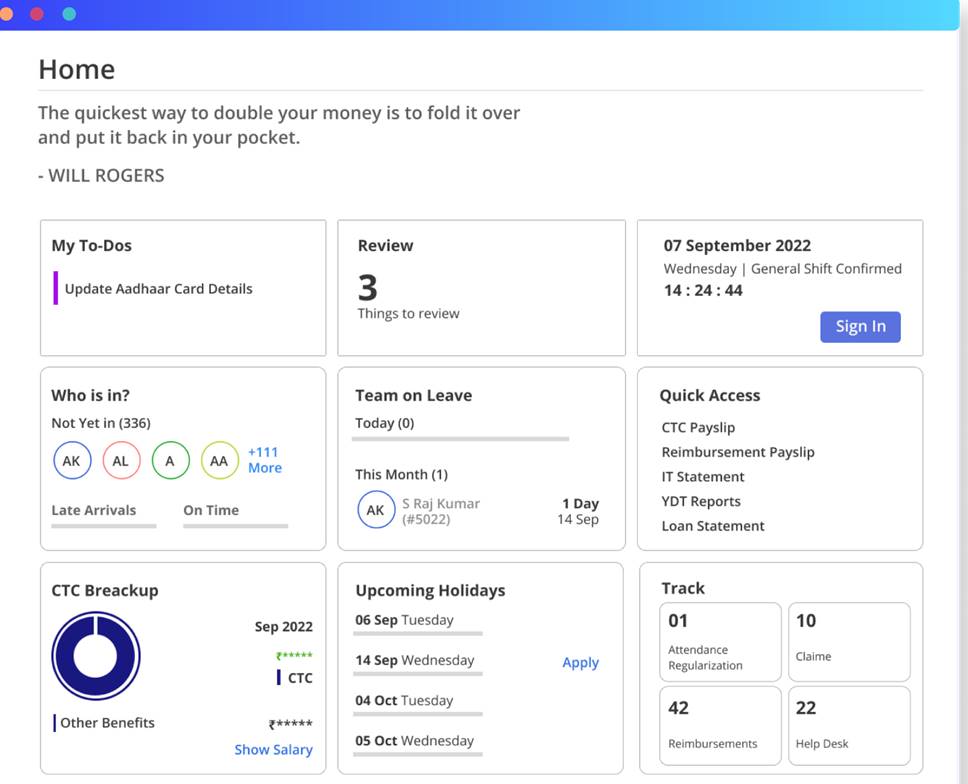

Quikchex

Quikchex is a one-stop HRMS specifically designed for Indian businesses. It is simple enough to use for a 20+ employee startup, yet configurable enough for 2000+ employee enterprises. With a market standing of over 40 years in the HR industry through its group companies, Quikchex has become a reliable HRMS tool for hundreds of companies in India. One of the biggest highlights of Quikchex is its Performance Management System that seamlessly integrates with its payroll and very easy to use.

The system also allows you to set custom PMS policies unique to your organization with ability to track 360 feedback with custom goal and competency set ups.

Pros:

1. The PMS functions of Quikchex are very easy to use for smaller startups at the same time configurable enough for larger enterprises

2. Seamlessly integrates with other aspects of their HRMS Solution

Cons:

1. May not be suitable for 10000+ employee larger enterprises.

-

HROne

HR One is a comprehensive cloud-based HR management platform that includes performance management as one of its key features. The performance management module of HR One offers goal-setting, continuous feedback, performance tracking, and review management capabilities. The platform is designed to be user-friendly and customizable, allowing organizations to tailor it to their specific needs. HR One also provides advanced analytics and reporting features, enabling data-driven decision-making for performance evaluation and improvement. In addition to performance management, HR One offers a range of other HR tools, such as payroll management, employee self-service, and recruitment. The platform is suitable for businesses of all sizes and provides excellent customer support.

Pros:

1. User-friendly interface that is easy to navigate and use.

2. Comprehensive range of HR tools beyond performance management.

Cons:

1. Limited integration options with other third-party systems or tools.

2. Some users may require additional training to fully utilize all the features of the platform.

-

Keka

Keka is a cloud-based HR management platform that includes a range of HR tools, including performance management. Their PMS module includes features such as goal-setting, continuous feedback, performance tracking, and review management. Keka’s PMS is designed to be easy to use and customizable, allowing organizations to tailor the system to their specific needs. The platform also includes analytics and reporting features that allow organizations to track employee performance and identify areas for improvement.

In addition to performance management, Keka offers a range of other HR tools, including payroll, time and attendance, and leave management. The platform is suitable for small to medium-sized businesses and offers excellent customer support. Overall, Keka’s PMS is a comprehensive solution for organizations looking to streamline their HR processes and improve employee performance

Pros:

1. Keka’s PMS is highly customizable and offers a range of features to support performance management.

2. The platform includes analytics and reporting features that allow organizations to track employee performance and identify areas for improvement.

Cons:

1. Keka may not be suitable for larger organizations with complex HR needs, as the platform is designed primarily for small to medium-sized businesses.

-

Darwin Box

Darwin Box is a cloud-based HR management platform that includes a range of HR tools, including performance management. Their PMS module includes features such as goal-setting, performance tracking, and review management. Darwin Box’s PMS is designed to be highly customizable, allowing organizations to tailor the system to their specific needs. The platform also includes advanced analytics and reporting features that allow organizations to track employee performance, identify areas for improvement, and make data-driven decisions.

In addition to performance management, Darwin Box offers a range of other HR tools, including recruitment, payroll, and leave management. The platform is suitable for businesses of all sizes and includes excellent customer support. Overall, Darwin Box’s PMS is a comprehensive solution for organizations looking to improve employee performance and streamline their HR processes.

Pros:

1. Offers a comprehensive range of HR tools beyond performance management, including recruitment and payroll management.

2. Highly customizable to meet the specific needs of an organization.

Cons:

1. May be too complex for small businesses or organizations with limited HR resources.

2. Pricing can be higher compared to some other performance management platforms.

-

BambooHR

BambooHR is a cloud-based HR management platform that includes a range of HR tools, including performance management. Their PMS module includes features such as goal-setting, performance tracking, and review management. BambooHR’s PMS is designed to be user-friendly and customizable, allowing organizations to tailor the system to their specific needs. The platform also includes reporting features that allow organizations to track employee performance and identify areas for improvement.

In addition to performance management, BambooHR offers a range of other HR tools, including recruitment, onboarding, and time tracking. The platform is suitable for small to medium-sized businesses and includes excellent customer support. Overall, BambooHR’s PMS is a comprehensive solution for organizations looking to improve employee performance and streamline their HR processes.

Pros:

1. Easy-to-use and intuitive UI

2. Offers a range of HR tools beyond performance management, including applicant tracking and onboarding.

Cons:

1. May not be suitable for larger organizations with more complex HR needs.

2. Pricing can be higher compared to some other performance management platforms.

-

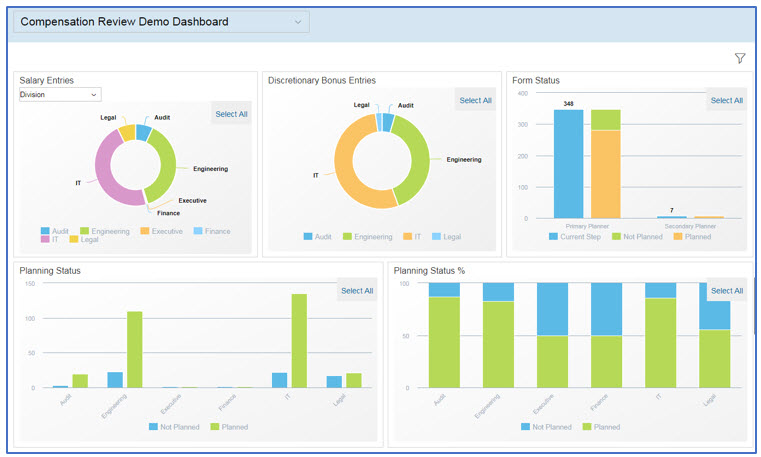

Success Factors

SAP SuccessFactors is a cloud-based human capital management software that offers a range of HR tools, including performance management. Their PMS module includes features such as goal-setting, continuous feedback, performance tracking, and review management. SuccessFactors PMS is designed to be highly customizable and can be tailored to meet the specific needs of an organization. The platform also includes advanced analytics and reporting features that allow organizations to track employee performance, identify areas for improvement, and make data-driven decisions.

In addition to performance management, SAP SuccessFactors offers a range of other HR tools, including recruitment, onboarding, and learning management. The platform is suitable for businesses of all sizes and includes excellent customer support. Overall, SAP SuccessFactors’ PMS is a comprehensive solution for organizations looking to improve employee performance and streamline their HR processes.

Pros:

1. Highly customizable to meet the specific needs of an organization.

2. Offers a comprehensive range of HR tools beyond performance management, including learning management and succession planning.

Cons:

1. Can be complex and require significant resources to implement and manage.

2. Pricing can be higher compared to some other performance management platforms.

-

Greythr

Greythr is an integrated HR and payroll management software that includes performance management as one of its modules. The performance management module of Greythr offers goal-setting, performance tracking, and review management capabilities. It provides a user-friendly interface and customizable features to align with an organization’s performance management processes. The platform also includes reporting features to track employee performance and identify areas for improvement. Greythr is suitable for businesses of all sizes and provides reliable customer support.

Pros:

1. Integrated platform with HR and payroll management capabilities.

2. Competitive pricing

Cons:

1. Limited advanced features compared to some other performance management platforms.

2. May require additional integrations with other systems for comprehensive performance management.

-

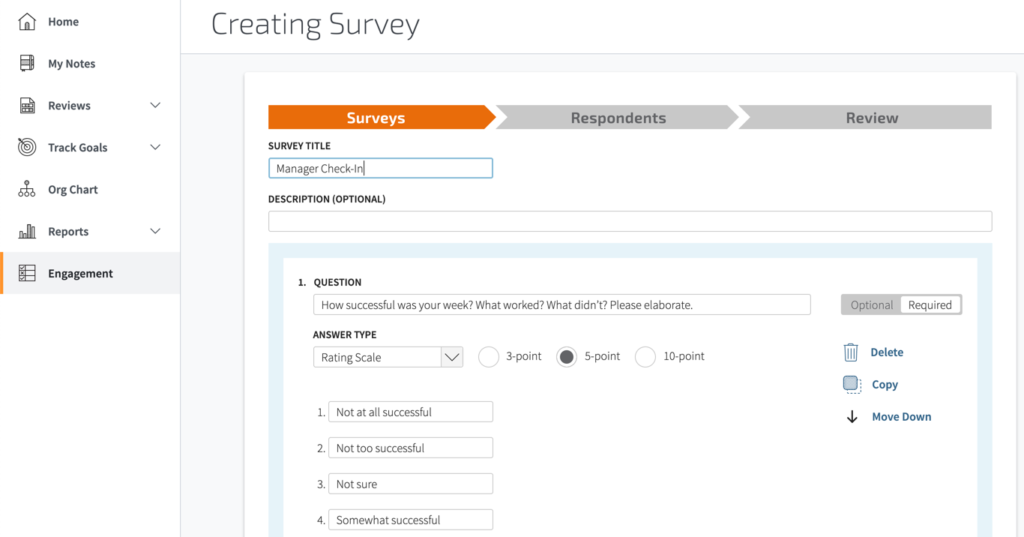

Trakstar

Trakstar is a cloud-based performance management platform that includes features such as goal-setting, continuous feedback, performance tracking, and review management. Trakstar’s PMS is designed to be user-friendly and customizable, allowing organizations to tailor the system to their specific needs. The platform includes analytics and reporting features that allow organizations to track employee performance and identify areas for improvement. In addition to performance management, Trakstar offers a range of other HR tools, including recruitment, onboarding, and learning management.

The platform is suitable for businesses of all sizes and includes excellent customer support. Trakstar is particularly well-suited for organizations that value simplicity and ease of use, as the platform is designed to be intuitive and user-friendly. Overall, Trakstar’s PMS is a comprehensive solution for organizations looking to improve employee performance and streamline their HR processes

Pros:

1. User-friendly platform design that is easy to navigate and use.

2. Offers a range of performance management tools, including goal-setting and 360-degree feedback.

Cons:

1. May be too simplistic for organizations with more complex HR needs.

2. Limited customization options compared to some other performance management platforms.

-

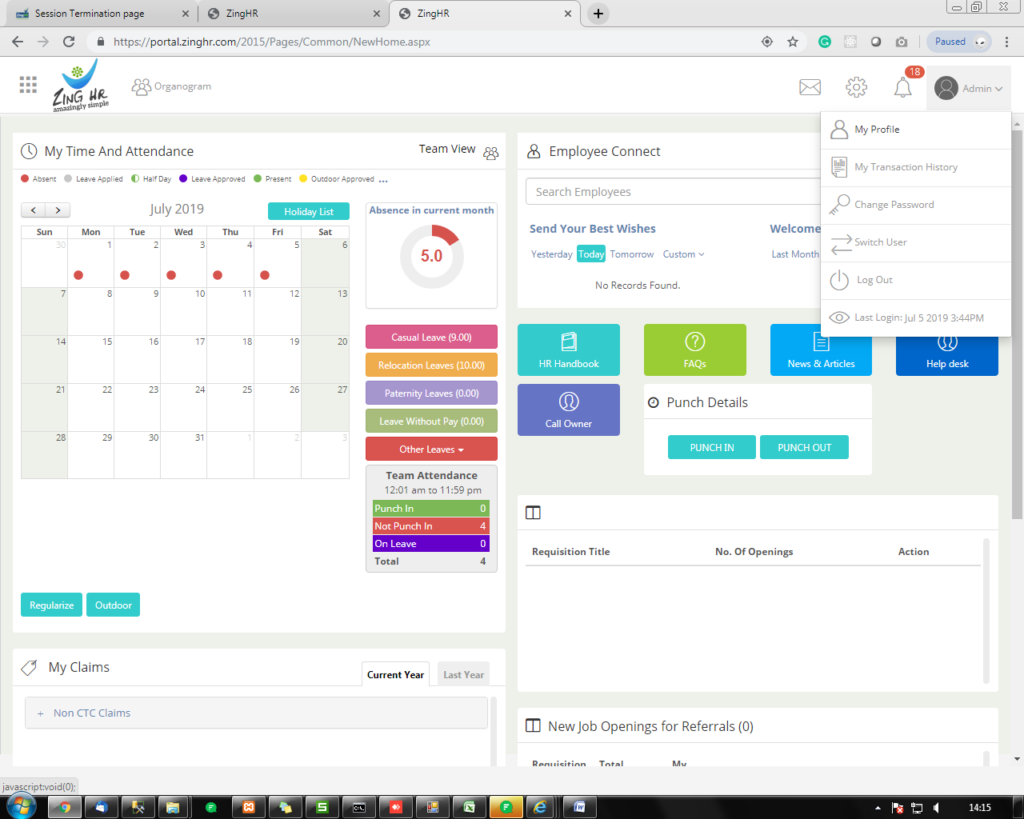

ZingHR

ZingHR is a cloud-based HR management platform that includes performance management as one of its key modules. The performance management module of ZingHR offers goal-setting, continuous feedback, performance tracking, and review management functionalities. It provides a user-friendly interface and allows customization to align with an organization’s performance management processes. The platform also includes analytics and reporting features to track employee performance and identify areas for improvement. ZingHR is suitable for businesses of all sizes and provides strong customer support.

Pros:

1. Easy-to-use platform with customization options.

2. Provides analytics and reporting features for data-driven decision-making.

Cons:

1. May require additional integrations with other systems for a complete HR management solution.

2. Limited advanced features compared to some other performance management platforms.

-

Synergita

Synergita is a cloud-based performance management platform that focuses on driving employee engagement and performance. Its performance management module includes goal-setting, continuous feedback, performance tracking, and review management features. Synergita offers a user-friendly interface and provides customization options to align with an organization’s specific performance management processes and metrics. The platform also provides advanced analytics and reporting capabilities to gain insights into employee performance and identify areas for improvement. Synergita emphasizes a continuous feedback culture and offers additional features like recognition and rewards to motivate employees. It is suitable for businesses of all sizes and provides strong customer support.

Pros:

1. Emphasis on continuous feedback and employee engagement.

2. Customizable to meet specific performance management needs.

Cons:

1. May require initial setup and configuration to align with organizational requirements.

2. Limited integration options with other HR systems or tools.

Conclusion: In conclusion, selecting the right performance management system can significantly impact an organization’s success. By considering factors such as cost, features, customization options, and user-friendliness, organizations can choose a platform that meets their specific needs. Each of the ten performance management systems reviewed in this article offers unique advantages and disadvantages, and ultimately the choice will depend on an organization’s specific requirements. By selecting the right system and effectively implementing it, organizations can improve their performance management processes and ultimately drive better results.